Jason Kenney is Giving Corporations a Massive Tax Giveaway That Will Cost Albertans $3.7 Billion

Widespread cuts to public services are expected

Alberta will lose 12% of the annual revenues it depends on to pay for public services thanks to a Donald Trump-inspired corporate tax giveaway announced this week by Alberta Premier Jason Kenney.

Flanked by Finance Minister Travis Toews and Lafarge Canada CEO Brad Kohl, Kenney confirmed Monday Alberta will roll back taxes on corporate profits from 12% to 10% on January 1, 2020. It will be lowered further to 8% in 2022.

A recent report commissioned by the Alberta Federation of Labour noted that Kenney’s corporate tax giveaway will remove 12% of public revenues the province currently invests in public services.

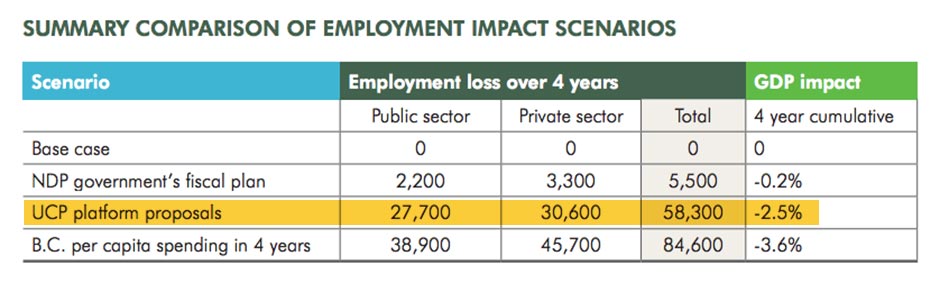

Kenney’s economic policies, including the corporate tax giveaway, are estimated to eliminate 58,000 Alberta jobs that pay living wages — that’s more jobs than were lost during the 2015 oil crash.

Hugh Mackenzie (AFL)

Kenney still has not explained which services he intends to cut to meet his balanced budget targets.

Economist Hugh Mackenzie, who authored the AFL report, says public services are in for tough times.

“Think of it this way,” Mackenzie told PressProgress: “If you think of eight things currently being done by the public sector, when this is done it will be seven.”

Mackenzie noted that even with a spending freeze, public education, postsecondary and health care services would deteriorate as they are all facing increasing needs due to Alberta’s growing population and shifting demographics.

During the announcement, Kenney falsely asserted that the corporate tax giveaway would create jobs despite decades of research that shows corporate tax cuts are a terrible job creation tool that only lead to corporate cash hoarding.

Instead of creating jobs, Mackenzie says the money is more likely to be returned to shareholders.

“What we know is that what happens to that additional cash is highly debatable,” Mackenzeie said.

“For example in the US there’s evidence that the substantial portion of Trump’s cuts just became increased cash for corporations to deploy in other ways.”

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate