Canada’s corporate tax cuts didn’t create jobs, they created corporate cash hoarding

Does cutting corporate taxes help grow the economy? The evidence seems to suggest no.

Does cutting corporate taxes help grow the economy?

The evidence seems to suggest no.

A new study out from the Canadian Centre for Policy Alternatives looked at this question, and they find no evidence billions in tax giveaways to corporations did much of anything to stimulate the economy or create jobs.

But the pile of money Corporate Canada is sitting on did get bigger.

The study, authored by Jordan Brennan, pours cold water on those who say more corporate tax cuts are the go-to solution to problems facing the economy – in fact, it looks like it’s a big part of the problem.

Here are a few things the study found instead:

1. Canada’s corporate tax rate has been falling for three decades

Canada’s federal corporate income tax rate was once as high as 42% in the 1950s, believe it or not (actually, a combined 52% when you include provincial corporate taxes too).

But since 1988, federal corporate tax rates nose dived, slashed repeatedly by Conservative and Liberal governments. Today it’s at the lowest rate in over half a century:

2. Cutting corporate taxes did not increase business investment or create jobs

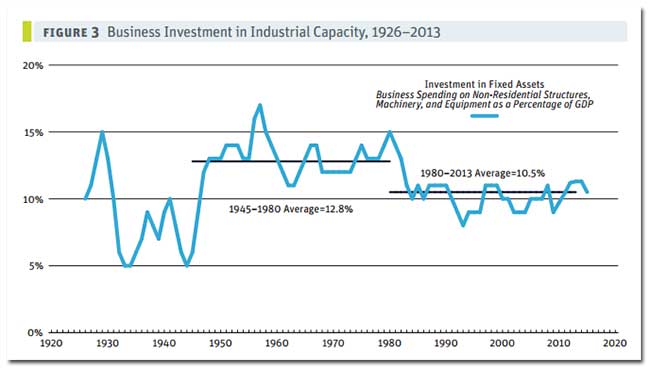

But although corporate tax cuts were justified by claiming it would free up money for investment, the opposite happened:

As Brennan explains:

“Significantly (and ironically), not only has investment failed to increase in recent decades in tandem with CIT rate reductions, the pattern that investment takes mirrors the CIT rate. In other words, after climbing in the 1940s and early 1950s, business investment trended downward from the 1960s onward. It was sharply reduced in the 1980s and has remained at a postwar low for three decades.”

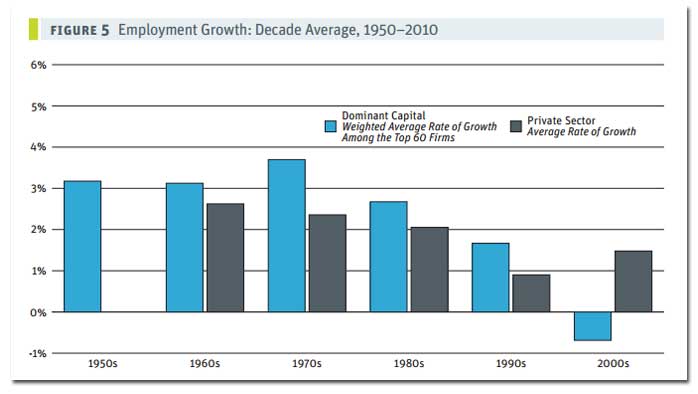

And what about job creation?

Despite claims that lowering corporate taxes creates jobs, job creation went down, not up:

Brennan elaborates:

“Between 2000 and 2010, the statutory CIT rate was nearly halved and the average rate of growth of employment among the top 60 firms was -0.7%. The pattern is similar for the private sector as a whole, which saw rapid employment growth in the decades when CIT rates were high (1960s and 1970s) and weaker employment growth in the decades when CIT rates were low and falling (1980s to 2000s).”

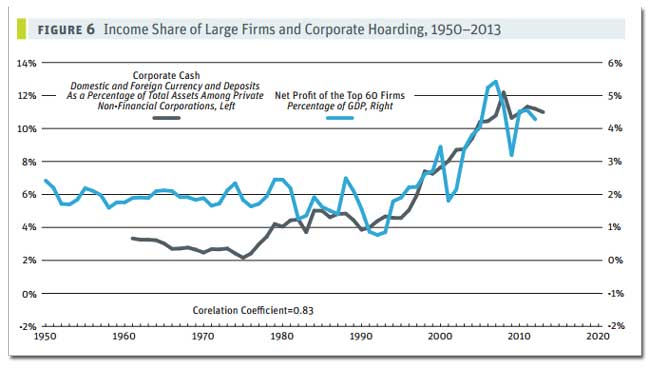

3. Cutting corporate taxes has led to cash hoarding

So where did all that money go?

“Rather than investing their enlarged earnings into growth-expanding industrial projects, Canada’s corporate sector has increasingly stockpiled cash on its balance sheet,” Brennan says.

Between 1990 and 2012, Corporate Canada tripled its stockpile of ‘dead money’ from 4% to 11% of assets, with most of that money being held by Canada’s 60 biggest companies:

What this suggests is corporate tax cuts are actually getting in the way of economic growth.

“This means the government frenzy for CIT rate reductions has exacerbated corporate cash hoarding, thereby depressing growth,” Brennan suggests.

“Far from spawning higher levels of investment and growth, the government fixation with corporate tax cuts has indirectly fostered slower growth,” Brennan says, speculating corporate tax cuts could “go down as one of the great public policy blunders of the past generation.”

A poll released in the fall showed 85% of Canadians want to raise taxes on corporations.

Increased revenue from corporate taxes could help stimulate economic growth by putting unused dead money to work through investments in infrastructure and social programs that create jobs and lower living costs for Canadians.

Photo: W.I.B. Used under Creative Commons License.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate