Federal Liberals’ ‘Middle-Class Tax Cut’ Overwhelmingly Benefits The Well-Off, Yet Again

We've seen this movie before

Prime Minister Trudeau is promising yet another “middle-class” tax cut, pitched as a “lift” out of poverty that will help the middle class and “those working hard to join it” — but, once again, those who benefit most are already fairly well-off and those who aren’t don’t really benefit.

But it does come at a hefty cost to public revenues.

Two days after the election, Trudeau told reporters “putting forward a bill to lower taxes for the middle class” by extending the Basic Personal Amount (BPA) exemption is a key priority for his minority government, as per the Liberal platform.

The Liberals’ plan to increase the BPA exemption to $15,000 won’t benefit Canada’s very richest. But Canadian Centre for Policy Alternatives senior economist David Macdonald told PressProgress, the second-highest income decile “makes the biggest benefit from this, compared to the first decile that makes almost nothing.”

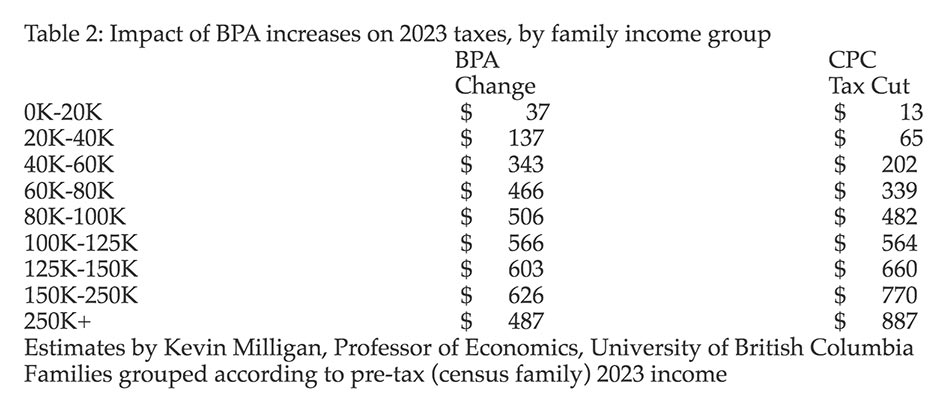

See below, calculations of how benefits break down by income bracket, between the Liberals’ BPA proposal and the Tories’ proposed Universal Tax Cut, by UBC prof. Kevin Milligan:

The Financial Post noted, meanwhile, even the biggest percentage change in disposable income would go to those earning from $40,000 up to $80,000. That’s above the 2018 Canadian median family income of $70,300.

Economist Andrew Jackson

However, that minuscule benefit will cost the government roughly $6 billion.

Canadians For Tax Fairness executive director Toby Sanger told PressProgress “There are positive things that you can do with the tax system at the lower end, particularly if you use a refundable tax credit. This isn’t that.”

Sanger noted, further, the Liberals’ latest proposal follows a track-record of tax policy that benefits the well-off over those struggling.

In their 2015 election manifesto, the Liberals promised to “conduct a review of all tax expenditures to target loopholes that particularly benefit the top 1 per cent.”

Despite the government raising taxes on incomes over $200,000 — when it did introduce its “middle-class tax cut”, Canada’s wealthiest 10% received half of all the benefits. That worked out to $1.5 billion in tax savings for everyone with taxable incomes higher than $89,200.

Following that, Finance Minister Bill Morneau handed corporate Canada $14 billion in tax giveaways, while maintaining many Harper-era tax loopholes that benefit Canada’s wealthiest income tax earners.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Become a member