Fraser Institute advises Liberal Finance Minister to pretend inequality does not exist

The Fraser Institute has a modest proposal for new Liberal Finance Minister Bill Morneau: please pretend inequality does not exist.

The Fraser Institute has a modest proposal for new Liberal Finance Minister Bill Morneau:

Please pretend inequality does not exist.

That’s the advice the Fraser Institute, which is a registered charity, gave Morneau in their latest blog post.

Citing Morneau’s experience as Chair of the right-wing C.D. Howe Institute, Ben Eisen and Jason Clemens express “hope” that “the research and ideas Morneau was exposed to during his time in the think tank world will help shape the government’s policies” – including what they describe as “hyperbolic claims” about a “perceived inequality crisis”:

“Morneau would be well-served by considering recent think tank research. For example, a recent paper shows that hyperbolic claims of rapidly growing income inequality are usually based on overly simplistic analyses that fail to take into account existing redistributive tax and transfer policies … Morneau should consider this evidence and reject populist policy responses to a perceived ‘inequality crisis’ such as higher capital gains taxes, corporate income taxes, and personal income taxes that would harm Canada’s economy.”

But is Fraser Institute’s advice evidence-based?

Well, for one thing, the only evidence Fraser Institute offers is a Fraser Institute study that comes to some pretty dubious conclusions.

Here’s what University of Ottawa economics professor Miles Corak’s took away from that Fraser Institute report:

“The study concludes, in the words of the screaming press release, that there is ‘No income inequality crisis in Canada when it’s properly measured.’ That is the wrong inference to be making. What the study is missing is a coherent understanding of the link the different measures it so accurately calculates. As a result it misses important policy lessons.”

And here’s what McMaster University economics professor Michael Veall pointed out:

“They haven’t said anything about the top one per cent, so their general discussion that the inequality numbers have been overstated is misleading because they haven’t included the top one per cent in their study.”

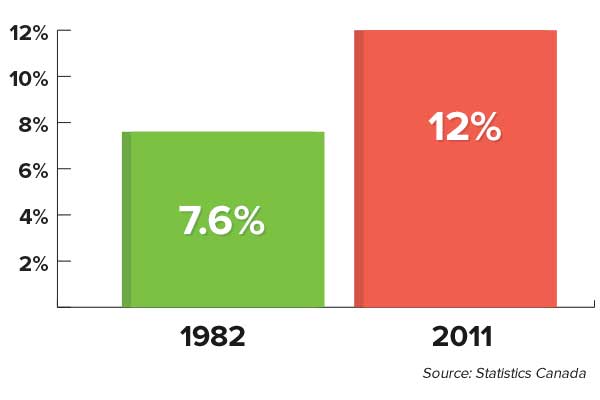

On that note, another recent study by Statistics Canada’s Andrew Heisz found the share of market income earned by the top 1% of earners “surged throughout the 1980s and 1990s, and by the 2000s was larger than in any decade since the 1930s.”

This has contributed to an even bigger concentration of wealth at the top.

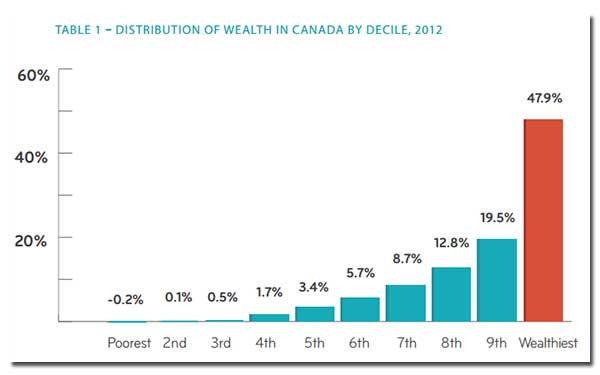

According to a 2014 Broadbent Institute study, the top 10% of Canadians owned nearly half (47.9%) of all wealth in Canada in 2012.

The bottom half of Canadians controlled less than 6% of all wealth in Canada.

Since 2005, Canada’s richest 10% have seen their median net worth rise by 41.9%, while the bottom 10% simultaneously saw a 150% drop.

Eisen and Clemens also direct Morneau to a 2012 study from the C.D. Howe Institute (his old think tank) that argues raising taxes on the rich leads to “reduced economic growth and weaker-than-expected revenue gains.”

Except, according to a recent study by the CCPA’s Lars Osberg, Canada could in theory raise taxes on those earning more than $205,000 by as high as an estimated ceiling of 65% before revenues would start to decline – something that could generate between $15.8 to $19.3 billion annually.

Photo: clappstar. Used under Creative Commons license.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate