Corporate Tax Freedom Day: Today Corporate Canada Stops Paying Taxes and Starts Hoarding Money For Itself

Canada’s effective corporate tax rate has been cut in half over the last two decades. Where did all that money go?

Corporate Canada is done paying taxes for the year.

Thanks to two decades of corporate tax giveaways, Canadian corporations paid off their collective tax bill at 9 am this morning — and the data suggests they won’t be putting their after-tax savings to productive use.

Corporate Tax Freedom Day, calculated by the progressive tax watch dog group Canadians for Tax Fairness, is the day when Canadian corporations have paid all their federal and provincial corporate income taxes based on their revenues.

Riffing on the right-wing Fraser Institute’s annual “Tax Freedom Day” gimmick, the report aims to highlight the impact of two decades of cuts to corporate income tax.

The study notes Canada’s “effective corporate income tax rate” — the amount of tax actually paid as a share of taxable income — declined to 18.8% in 2018, the latest year for which data is available.

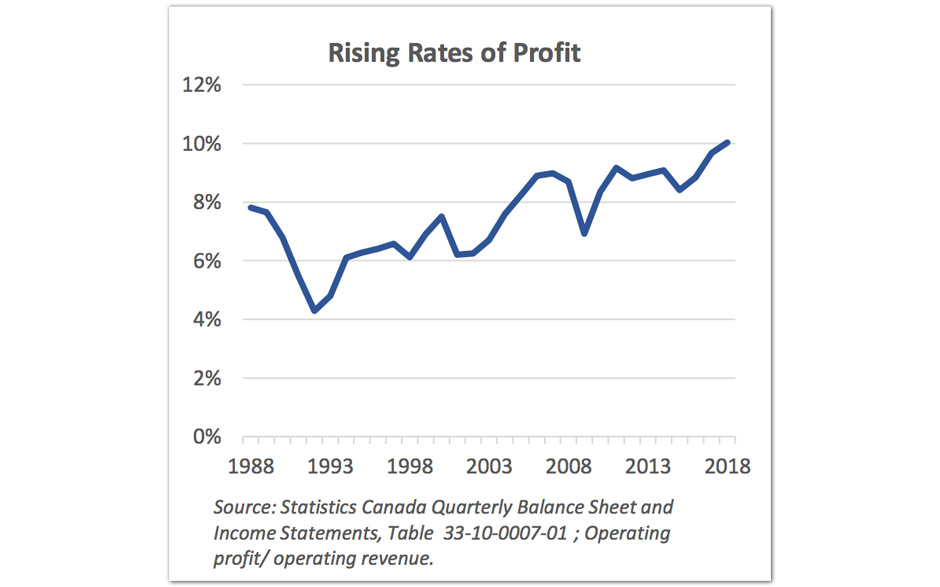

“Average operating profits of Canadian corporations as a share of revenues reached 10% in 2018 for the first time since at least 1988,” Canadians for Tax Fairness says.

Canadian corporations only paid $75 billion in provincial and federal corporate taxes despite posting nearly half a trillion in profits.

Canadians for Tax Fairness

That’s not only “well-below” the combined average federal and provincial statutory rate (26%), it’s also less than half the effective corporate income tax rate was 20 years ago (closer to 40%).

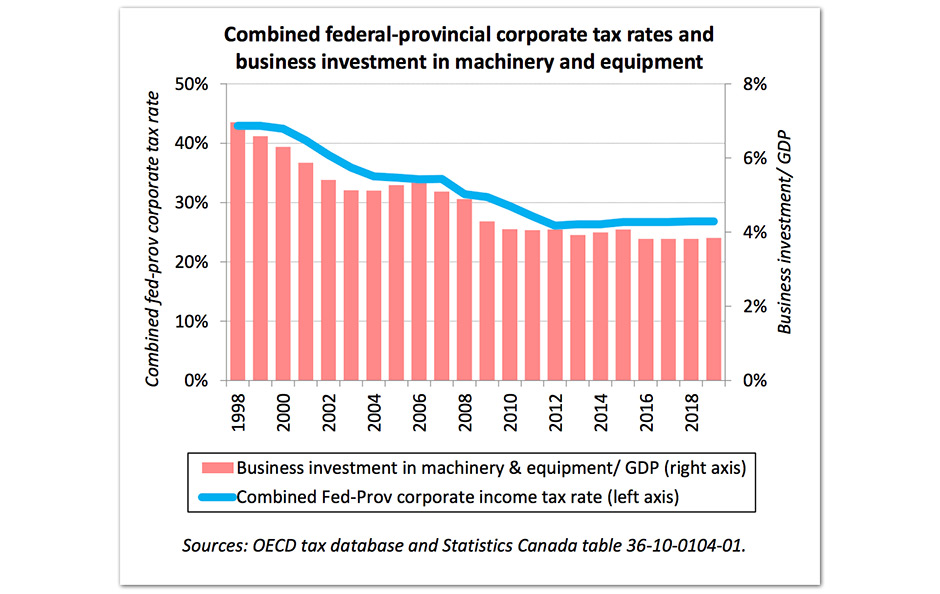

“Advocates for lower corporate taxes have claimed tax cuts are essential to retain and attract business investment” and “stimulate economic growth,” the report points out.

But that’s not what’s happening — while Canada’s effective corporate tax rate fell over these two decades, corporate Canada’s business investments in machinery and equipment also fell as a share of GDP.

In 1998, the share of Canada’s GDP spent on machinery and equipment was 7%. In 2018, it was just over half that — 3.8%.

Canadians for Tax Fairness

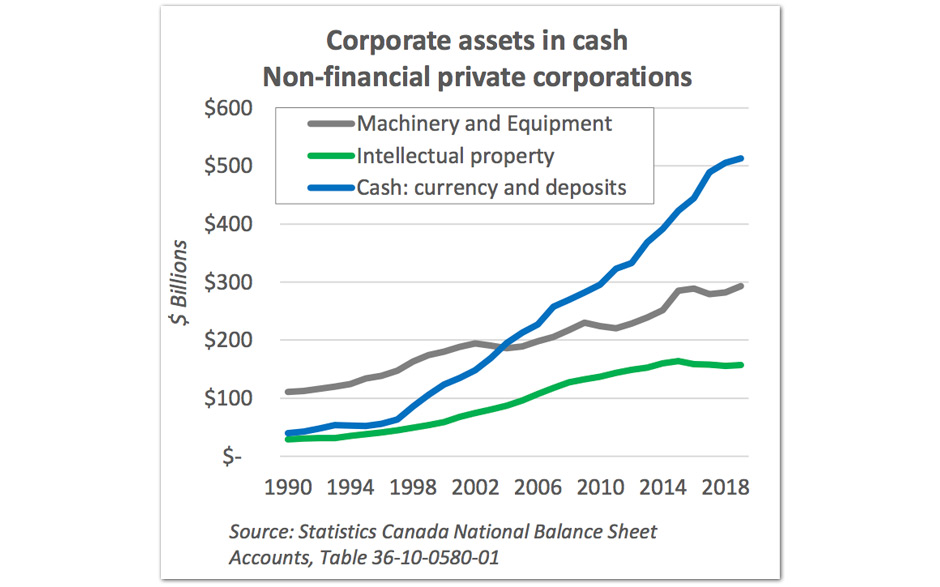

So where did the money go? The amount of cash (currency and deposits) held by Canadian non-financial private corporations more than quadrupled during that same period — most recently amounting to $532 billion.

$532 billion is about 23% of Canada’s annual economic output and three-quarters of the federal government’s debt.

Canadians for Tax Fairness

Additionally, the report notes the average compensation for Canada’s top 100 CEOs also rose from $3.8 million to $11.8 million.

In fact, 23 top companies paid more in compensation to their top executives in 2018 than they paid in corporate taxes.

Canadian Centre for Policy Alternatives Senior Economist David MacDonald says the findings stand in contrast to the Fraser Institute’s version of tax freedom day.

“If you use the same methodology based on revenue for both personal income taxes and corporate income taxes, the corporate income taxes are far lower on that basis,” MacDonald told PressProgress.

Despite calls from big business and right-wing think tanks for lower corporate taxes, MacDonald says the report shows giving corporations “no-strings attached money” does not lead to a “re-investment boom.”

“The results are predictably smaller government budgets meaning degraded public services, but at the same time higher corporate profits and more money flowing to rich executives and rich shareholders.”

The Fraser Institute did not respond to a request for comment from PressProgress.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate