The Federal Government Says Budget 2024 Makes The Wealthy Pay Their ‘Fair Share’. Economists Say The Rich Could Be Paying More.

Budget 2024 introduces changes to how capital gains are taxed, but it will only capture a fraction of the wealth held by Canada’s top 0.13%

The Liberal government wants everyone to know their new tax measures will make “the very wealthiest pay their fair share” – but will the rich really “pay their fair share”?

It’s no secret the Liberal government is struggling to energize voters. The night before the federal budget, unnamed government sources leaked details of its plan to tax the rich to CBC News, the Globe and Mail, the Toronto Star and Global News.

Budget 2024 proposes to do so by making changes to the taxation of capital gains, which refers to income earned on the sale of capital assets – things like investments or real estate, for example.

During the COVID-19 pandemic, wealthy Canadians got wealthier thanks to real estate and stock markets. According to Statistics Canada, when capital gains are included, the top 0.1% of Canadians saw their average income skyrocket 27.6% between 2020 and 2021.

While Canadians who work jobs see the full value of their wages or salaries subject to tax, wealthy individuals who make money playing the stock market or flipping houses only see half the value of that income subject to taxes – something critics argue is a double-standard that benefits the rich.

Budget 2024 will change the way capital gains are taxed by increasing the “inclusion rate on capital gains realized annually above $250,000 by individuals and on all capital gains realized by corporations and trusts frome one-half to two-thirds.”

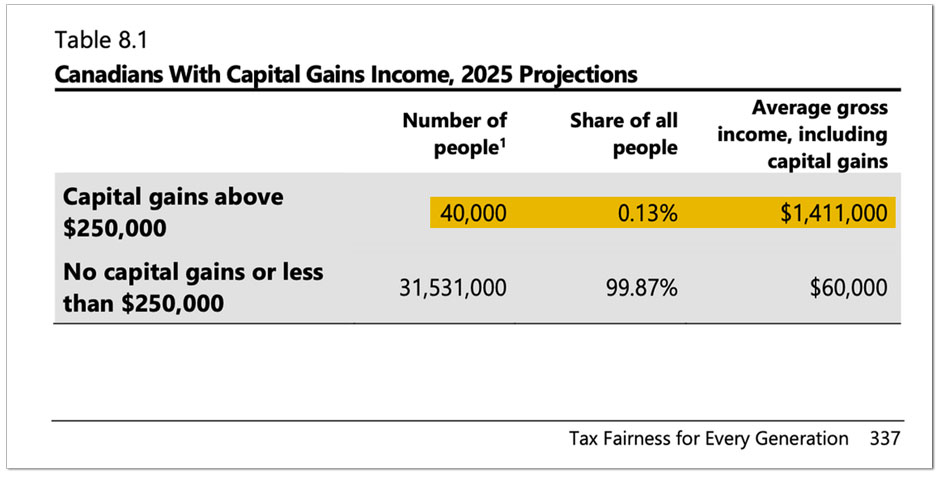

The Liberal government is careful to note the changes to capital gains taxation is targeted at the top 0.13% of all Canadians and does not impact the bottom 99.87% of Canadians.

According to Finance Canada’s numbers, that would impact only 40,000 individual Canadians who have an average gross income of $1.4 million. It will also impact 307,000 corporations, accounting for 12.6% of all incorporated businesses in Canada.

Budget 2024 (Finance Canada)

“Next year, 28.5 million Canadians are not expected to have any capital gains income, and 3 million are expected to earn capital gains below the $250,000 annual threshold. Only 0.13 per cent of Canadians with an average income of $1.4 million are expected to pay more personal income tax on their capital gains in any given year.”

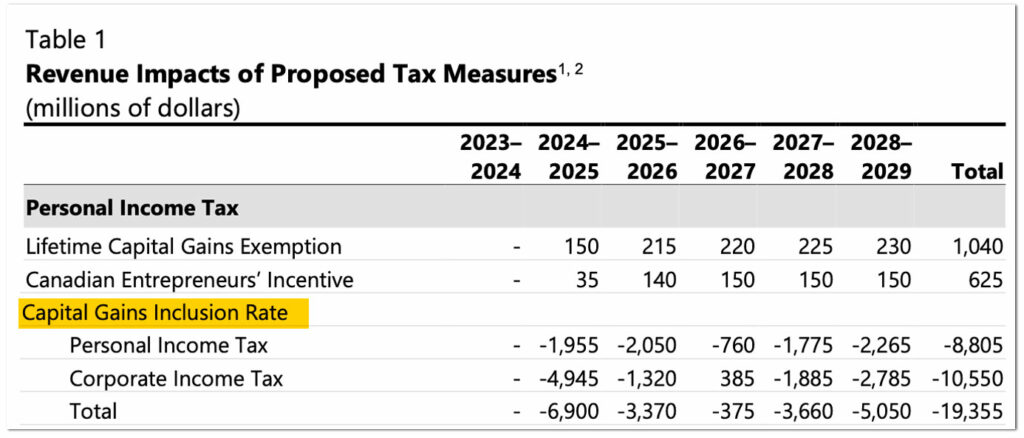

Overall, Finance Canada says the proposed changes to taxing capital gains will generate an additional $6.9 billion in revenue in 2025, with $1.9 billion coming from wealthy individuals and $4.9 billion coming from corporations.

For individuals, those numbers will fluctuate between $760 million and $2.2 billion over the next five years due to behavioural changes and pull forward impacts, leading to $8.8 billion over five years.

Including corporations, that generates a combined $19.3 billion over five years.

Budget 2024 (Finance Canada)

Although Budget 2024 changes the capital gains inclusion from 50% to 66%, progressive organizations have called for raising the capital gains inclusion rate to 100%.

The federal NDP has campaigned on raising it to 75%. A 2021 Parliamentary Budget Office assessment of the NDP platform proposal concluded that raising the capital gains inclusion rate to 75% would generate $44.7 billion in new revenue over five years – more than double the revenue the Liberal government’s changes will generate.

The amount of wealth held by Canada’s super-rich is significant. Statistics Canada data indicates Canada’s top 1% – a group consisting of about 292,560 individuals – generates over $140 billion each year in market income. Among the top 0.1%, a smaller group consisting of 29,260 ultra-wealthy individuals, that amounts to $62.8 billion.

DT Cochrane, Senior Economist with the Canadian Labour Congress, thinks the federal government “could go much further.”

“It’s undeniably good that they’re increasing the inclusion rate at all, but it could be better,” Cochrane told PressProgress.

“Capital gains overwhelmingly flow to the richest of the rich,” Cochrane said. “The government is targeting those with capital gains over $250,000, but that’s an extremely high threshold only capturing the richest 0.13% who, yes, collect the disproportionate amount of the capital gains, but there’s a lot of room below that threshold to increase the revenue from a form of income that most people are seeing very little of.”

Finance Minister Chrystia Freeland (Photo: Luke LeBrun, PressProgress)

In a press conference, Freeland defended the capital gains tax change amid suggestions that it would deal a blow to investments.

“We thought very, very carefully about the investment climate,” Freeland told reporters. “I am confident that the measure that we are putting forward today will not have negative effects on business certainty, on business investment.”

Cochrane says those concerns are based on assumptions which are rooted in discredited right-wing trickle-down economic theories.

“There’s no reason to believe that the private sector is allocating capital in a way that’s beneficial to Canadians and lots of reasons to believe that public agencies can allocate capital where it needs to go much better,” Cochrane said, adding that a lot of wealthy individuals and corporations are just “sitting on wealth.”

“We’re losing out on a lot of revenue that could pay for a more ambitious pharmacare program, more direct investment in affordable housing or increased wages for long-term care workers, as just a few examples.”

Budget 2024 (Luke LeBrun, PressProgress)

Canadian Centre for Policy Alternatives Senior Economist David Macdonald would like to see the inclusion raised to 100% but calls the announcement a “good measure” given the circumstances, noting it is actually a return to the way capital gains were taxed before the 1990s.

“It’s only 40,000 people out of 40 million who are going to pay this,” Macdonald told PressProgress. “They get a half-off coupon and make on average $1.4 million per year.”

Macdonald said wealthy Canadians still get a tax break after the change, the only difference is that the tax break will be “smaller.”

“Now, they’re only going to get a 33% off coupon on that instead of a half-off coupon,” Macdonald said. “Everybody else pays regular income taxes, they don’t get a third-off coupon or a half-off coupon.”

Despite the small number of ultra-wealthy people impacted by the change, Macdonald said he expects to see a “strong and immediate pushback.”

“There’s only 40,000 people who are going to pay it and they’ve got the means to hire the best lobbyists, the best tax accountants, the best lawyers to fight this and so they have about a year to fight it.”

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate