British Columbians are Paying More For Housing Because the BC Liberals Turned a Blind Eye to Dirty Money

Here’s how the BC Liberals’ failure to take action on money laundering made the housing crisis worse

Housing costs for ordinary British Columbians have been skyrocketing for over a decade thanks to the old BC Liberal government turning a blind eye to criminal money laundering in the province’s real estate market.

According to an explosive report by the BC government’s Expert Panel on Money Laundering in BC Real Estate, an estimated $5 billion is being laundered through BC’s real estate market every year, driving up housing prices by 5% or more.

In areas like Metro Vancouver, the cost of buying a home has likely increased by “upwards of 20%” as a result of money laundering.

A number of reports have placed blamed squarely at the old BC Liberal government for failing to respond to multiple warnings about money laundering in several sectors of the province. A few examples include:

- Overlooking a 500% increase in Provincial Sales Tax rebate claims used by criminals laundering cash on the luxury car market in 2016.

- Firing a team of investigators working for BC’s gambling watchdog in 2014 after they warned of “suspicious cash increasing at an alarming rate” in BC’s casinos.

- Ignoring warnings from Financial Transactions and Reports Analysis Centre (FINTRAC) about “significant deficiencies” in the way 55 real estate companies reported the money sources of property investors.

Here’s a rundown of how the old BC Liberal government’s loose rules and negligence allowed dirty money to distort BC’s real estate market, worsening the province’s housing affordability crisis.

Money launderers set up fake ‘shell companies’

Before the current BC government introduced new regulations under the Land Owner Transparency Act, last year, property-buyers could purchase real estate anonymously.

That allowed some criminals to funnel their cash through fake corporations called ‘shell companies’, typically set-up in tax havens such as the Syechelles or the British Virgin Islands. Those countries have very low corporate tax rates, and also allow company owners to keep their identities secret.

This practice, known as ‘layering’, allowed criminals to mask their identities and avoid detection from the Canadian authorities.

Money launderers buy properties at inflated costs.

Since money launderers are typically looking to make large sums of illicit cash appear legitimate, they’re often happy to outbid competing buyers on the housing market by offering to pay hugely inflated prices for properties.

A report by former RCMP officer Peter German last year noted money launderers prefer real estate for two main reasons:

- Real estate, especially in BC, typically doesn’t depreciate in value.

- Current regulations mean mortgage brokers and lawyers aren’t required to report suspicious transactions to bodies like FinTRAC.

The report also notes mortgage brokers and realtors involved in shady sales may also have financial interests in turning a blind eye. It reads:

“Appraisers, mortgage brokers, real estate agents and others who earn a commission based on the value of a transaction benefit from overvaluations and can be complicit in inflating a property’s value.”

The cost of buying a home goes up and up

Because money launderers pay massively inflated prices for already expensive real estate, they drive up average housing prices and distort the real estate market.

According to German’s report:

“Individuals wishing to launder money through a property deal have a perverse incentive to overpay, as it enables them to wash larger sums through each transaction. This activity impacts housing affordability, as above-market purchases drive up prices of comparable properties in the surrounding area.”

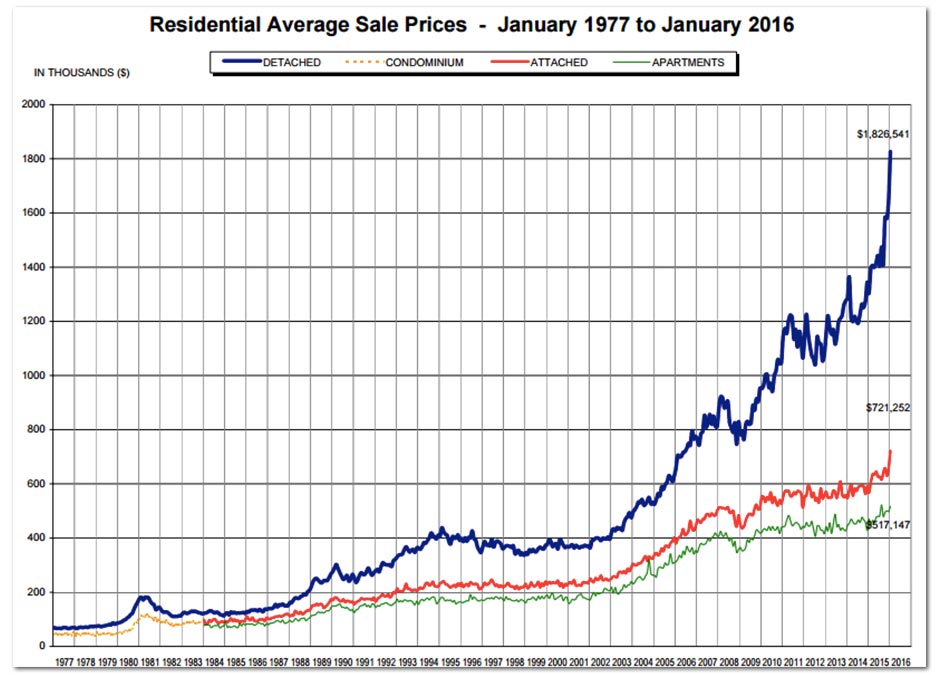

Although sale prices for properties decreased slightly in 2019 in Vancouver, under the BC Liberals’ watch between 2006 and 2016, housing prices skyrocketed at an unprecedented rate.

According to data from the Real Estate Board of Greater Vancouver, the cost of a detached home increased by 159% while the cost of an attached home increased 81%.

Chart: Real Estate Board of Greater Vancouver

Vancouver remains one of the most expensive cities in North America.

The cost of rent goes up too

Increases in property values mean landlords can charge higher rents for struggling tenants, as more would-be buyers are forced to compete for rental housing.

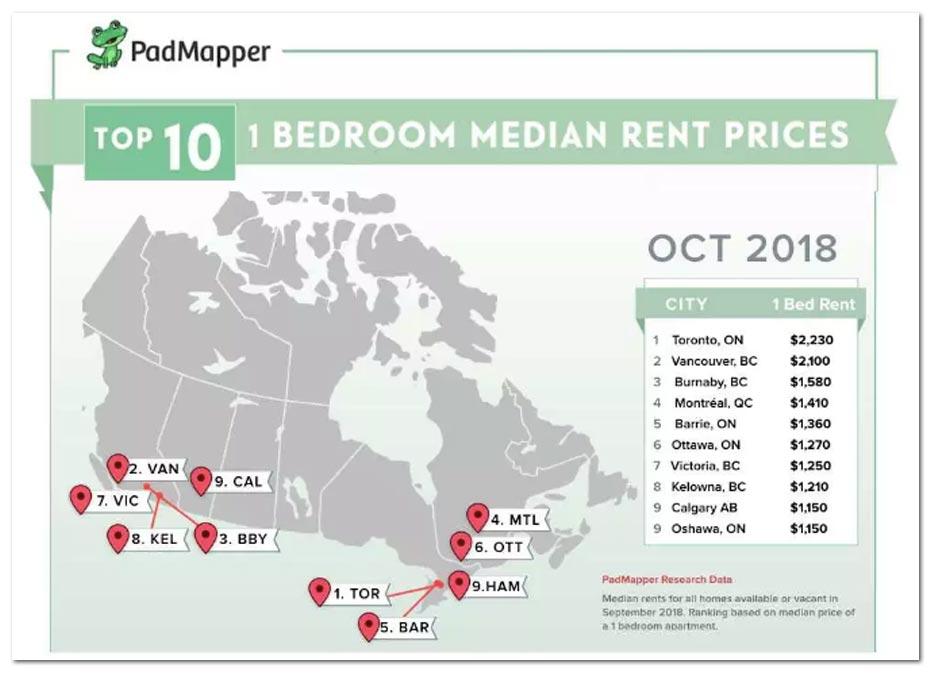

Rents in Vancouver spiked 2.4% last year, meaning the average rent for a one bedroom apartment reached $2,100 per month. That made Vancouver the second most expensive city for Canadian renters in 2018.

Graphic: Padmapper

Sky-high rents are a key factor in BC’s affordability crisis. The province had the highest proportion of residents spending more than 50% of their gross income on rent and utilities last year.

According to the Canadian Rental Housing Index, Vancouver ranks as “severely unaffordable” for lowest-income residents, and “unaffordable” for second-lowest income residents.

Despite difficulties faced by renters, BC Liberal leader Andrew Wilkinson claimed in February the BC NDP government was spending too much time “pandering to renters.”

Though BC’s housing crisis is mainly the result of speculation and high levels of debt, criminals and mobsters looking to hide money by purchasing expensive real estate made it even worse.

The BC government announced Wednesday it is launching a public inquiry into widespread money laundering in the province’s housing market and casinos.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate