Canada Revenue Agency is Losing $25 Billion Per Year to Corporate Tax Dodgers and Offshore Tax Havens

Canada Revenue Agency is doing a really bad job collecting taxes from big corporations and wealthy elites

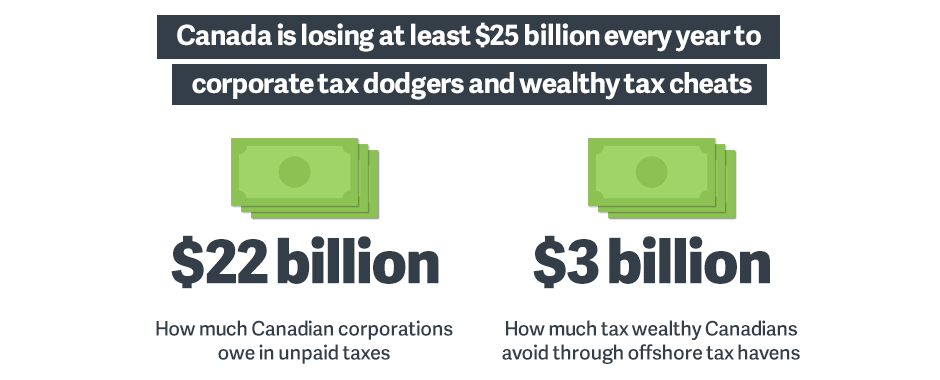

Corporate tax dodgers and wealthy elites stashing money in offshore tax havens cost Canada as much as $25 billion per year, according to Canada Revenue Agency.

On Thursday, Canada’s tax collection agency published its first ever estimate of the international tax gap, revealing wealthy Canadians are evading up to $3 billion in tax every year through offshore tax havens.

The CRA estimates the amount of money wealthy Canadians are stashing offshore could range between $75.9 billion and $240.5 billion.

Meanwhile, earlier this week, CBC News obtained internal CRA documents that suggests Canada is losing more than $22 billion per year to corporate tax dodgers.

Together, corporate tax dodgers and wealthy elites are now costing Canada at least $25 billion every year – that alone would cover the costs of a national pharmacare plan, introduce a national child care program and cut poverty in Canada in half.

Source: Canada Revenue Agency

Although one word of caution: Canada could actually be losing a lot more than this.

Senator Percy Downe cautions that “CRA’s numbers can’t be trusted,” noting that “the CRA has skin in the game – the lower the number the better they look.”

Earlier this year, CRA turned over its raw data to the Parliamentary Budget Officer who will conduct their own analysis of Canada’s tax gap. That’s expected next fall.

A big part of the current problem facing CRA are the massive cuts to the agency under Stephen Harper’s Conservative government, including the elimination of 3,100 full-time jobs.

As CBC News notes:

“The rise in the tax debt level over the last decade or so appears to be linked to major staff reductions at CRA under the former Conservative government’s deficit-cutting program.”

Justin Trudeau’s Liberals restored some funding to hire new auditors to collect unpaid taxes and crack down on the flow of money to offshore tax havens, but even with the new money from Trudeau’s Liberals, yet CRA still appears to have fewer auditors than it did before Harper’s cuts.

Now the amount of revenue Canada is losing is growing larger every year.

CRA not able to keep up with tax collection; debt rising. Staffing still not where it needs to be after Harper’s cuts. #taxfairness #taxjusticehttps://t.co/QOGMK71bNu

— Cdns 4 Tax Fairness (@CdnTaxFairness) June 25, 2018

A weakened CRA has allowed Canada’s rich and powerful to take advantage: tax lawyers and accountants push increasingly complex and aggressive tax avoidance schemes that overwhelm CRA’s capacity to enforce the rules.

One result has been fewer tax auditors to handle large and complex tax cases. As a result, CRA avoids going after big money tax dodgers and puts its energy into going after low-hanging fruit, like single moms and minimum wage workers. Another result has been companies luring CRA officials to leave the agency and come work with them on the other side.

The tax watchdog group Canadians for Tax Fairness has offered a few solutions to the problems, including calling on the government to restore “adequate staffing levels” at CRA and suggesting international “corporate tax avoidance could be solved with legislative changes at home.”

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate