VIDEO: Hey, average Canadians – your wages are flatter than a pancake

The average Canadian may be thinking twice about buying maple syrup this year. That’s because the average Canadian hasn’t seen a meaningful wage increase in six years and will be likely to see a decrease when final data for 2014 is released, says Andrew Jackson, senior policy advisor to the Broadbent Institute. “Real wages are pretty […]

The average Canadian may be thinking twice about buying maple syrup this year.

That’s because the average Canadian hasn’t seen a meaningful wage increase in six years and will be likely to see a decrease when final data for 2014 is released, says Andrew Jackson, senior policy advisor to the Broadbent Institute.

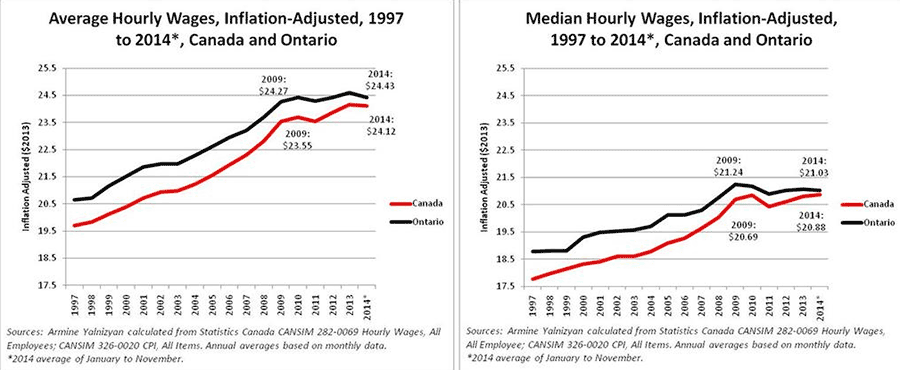

“Real wages are pretty much flat across the board,” Jackson said, writing for the Globe and Mail’s Report on Business. “During the four years from 2009 through 2013, average hourly wages adjusted for inflation rose by a grand total of just 2.3%, or by about one half of 1% per year.”

In fact, Jackson says “2014 will turn out to be a year in which real wages fell,” pointing out that between November 2013 and November 2014, the average hourly wage rose by only 36 cents, from $24.57 to $24.83 per hour – a 1.5% increase that falls well under the 2.0% inflation rate registered over the same period.

Examined over a wider span, it’s clear that across Canada – and particularly in Ontario – average Canadians have seen their wages flatten out since 2008:

So, how do we right the ship?

A report from the United Nations’ International Labour Organization lays blame for stagnating wages on profit-driven ‘trickle down economic’ policies that grind down collective bargaining institutions, labour unions and minimum wages, while simultaneously distributing profits up the drain by “exempting capital gains from income taxation, or reducing the corporate income tax.”

Instead, the report calls for a “wage-led growth strategy” that emphasizes “distributional policies that are likely to increase the wage share and reduce wage dispersion include increasing or establishing minimum wages, strengthening social security systems, improving union legislation and increasing the reach of collective bargaining agreements.”

Higher real wages, the report reasons, will end up boosting demand for the various components of gross domestic product on the expenditure side, including “consumption, investment, net exports, and government expenditures.”

In other words, as former U.S. secretary of labor, Robert Reich, told the Broadbent Institute’s Progress Gala in November – the real “job creators are people with money in their pockets”:

Photo: Twitter

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate