Statistics Canada Finds New Evidence Multinational Corporations are Dodging Canadian Taxes

Corporations are legally getting away with avoiding taxes using elaborate multinational profit-shifting schemes

New data from Statistics Canada finds fresh evidence multinational corporations are using profit-shifting schemes to avoid paying their fair share of taxes.

Canada Revenue Agency recently released a Tax Gap report that found Canadian corporations dodged $11 billion in taxes in 2014.

Now Statistics Canada has published additional evidence revealing multinational corporations sent significant profits to low-tax jurisdictions between 2011 and 2016 through various legal maneuvers, significantly eroding public revenues.

One way companies shift profits is by selling stuff to their own subsidiaries located in other jurisdictions. This transfers a company’s revenue from a high-tax jurisdiction to a low-tax jurisdiction, and allows the company to get away with paying fewer taxes overall.

While that kind of activity is legal, the report notes such behaviour “impacts government revenues worldwide” — in other words, companies can legally avoid paying taxes that fund essential public services, like schools and hospitals.

Toby Sanger, executive director of Canadians for Tax Fairness, told PressProgress Statistics Canada’s latest findings shed more light on the ways that large multinationals skip taxes with impunity.

“It’s particularly relevant now,” he said. “The IMF estimates that across OECD countries the average loss to revenues to tax-shifting of this sort is 1% of GDP. That’s about 20 billion for Canada.”

“Large corporations are basically trying to dodge about a third of the taxes that they have owed,” he added. “That’s twice the rate of small and medium size enterprises.”

In Statistics Canada’s latest report, analysts Alexandre Fortier-Labonté and Claire Schaffter highlighted three main common trends in Canadian corporate profit-shifting activity:

1. Companies made suspiciously large investments that don’t make economic sense

The report found high levels of outward Canadian foreign direct investment (FDI) in countries with small economies but low corporate taxes.

For example, In 2016, more than one-fifth of Canadian outward FDI went to countries with low corporate tax-rates, but with a relative GDP size of just 0.3% (when compared with other countries with high stocks of Canadian FDI).

The report notes that discrepancy indicates companies likely made such investments to avoid taxes, rather than because of “real economic factors.”

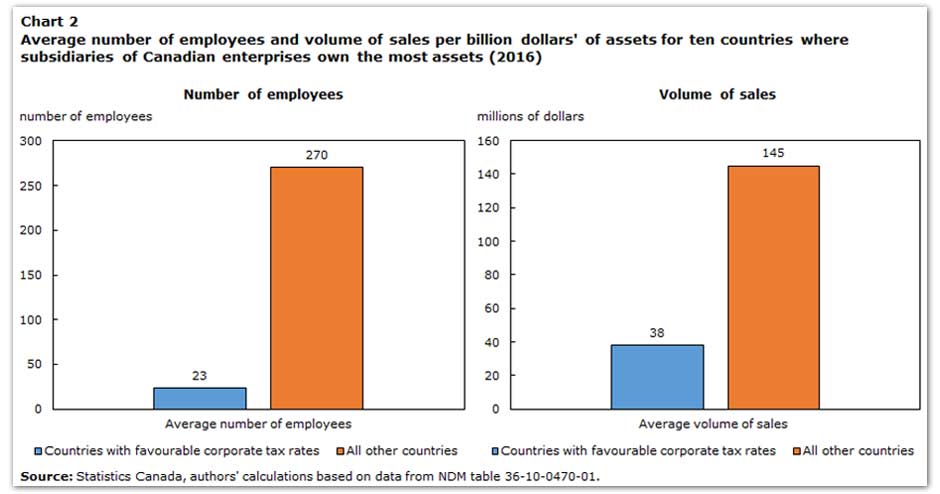

The report also found that corporate subsidiaries in jurisdictions with these lower tax and GDP rates had just 23 employees per billion dollars in assets, compared with 270 employees in all other countries.

Low-tax subsidiaries also had much lower sales volumes than affiliates in other countries– just $38 million per billion dollars of assets compared with $145 million per billion elsewhere.

Source: Statistics Canada

2. Subsidiaries in low-tax areas accounted for suspiciously high proportions of company profits

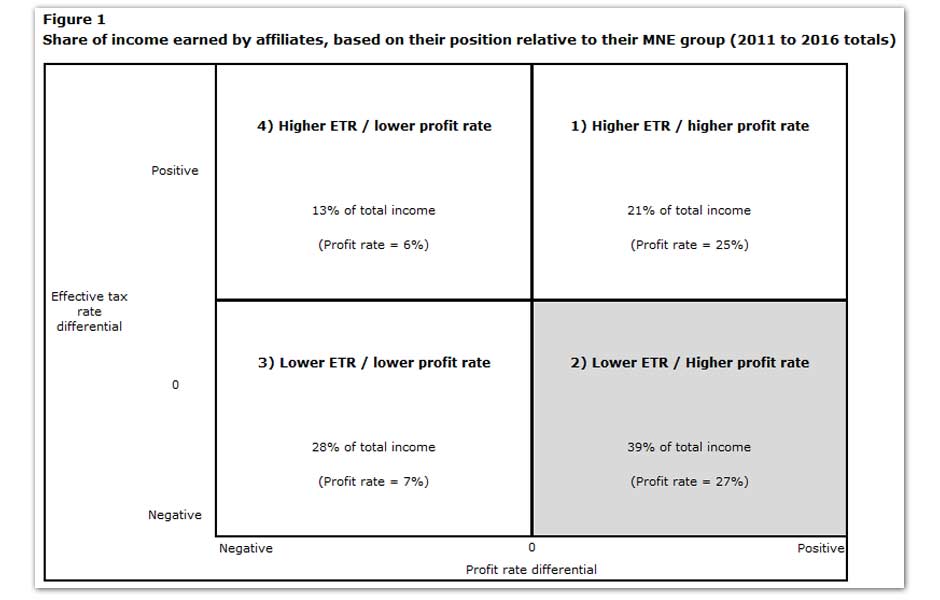

Despite hiring fewer employees and having lower sales volumes, subsidiaries with high profit rates in low-tax jurisdictions accounted for the highest proportion of income in their multinational corporations between 2011 and 2016–39%.

During that period, corporate affiliates in low tax regions were more than twice as profitable as their groups’ averages overall.

The report said that likely means multinationals shifted income to inflate the profits of those low-tax jurisdiction subsidiaries. This would make a company’s total revenue subject to fewer taxes.

Source: Statistics Canada

That view appears to be shared by CRA staff. A Professional Institute of the Publish Service of Canada survey last year found that 90% of members of the CRA’s Audit, Financial and Scientific Group believed Canada’s tax system make it much easier for corporations and wealthy individuals to avoid paying their fair share of taxes and 75% said multinational corporations shift profits to low-tax regions even when there is no economic reason to do so.

“There are a number of loopholes and grey areas in the existing laws. It’s not illegal for companies or wealthy individuals to take advantage of those loopholes, but they need to be closed, because it results in not everybody paying their fair share,” said Debi Daviau, president of PIPSC.

3. Multinational companies with foreign subsidiaries paid much lower tax rates than non-multinational businesses

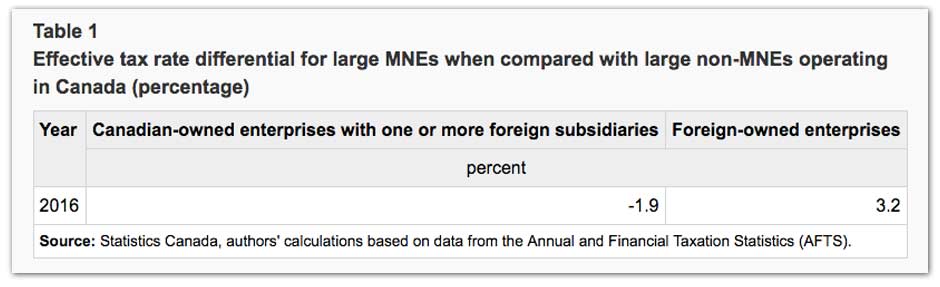

The report also found that Canadian-owned multinational companies that had the capacity to shift income to low-tax jurisdictions paid a 1.9% lower effective tax rate than non-multinational companies in 2016.

In other words, the largest corporations are able get away with paying fewer taxes than non-multinational enterprises.

Source: Statistics Canada

Earlier this year, a different set of data revealed that Canadian corporations held $353 billion in 12 of the world’s biggest tax haven destinations in 2018–an all time high.

Corporate concentration is a key factor that facilitates tax avoidance, since companies with larger shares of consumers are better positioned to take advantage of tax loopholes and profit-shifting schemes.

Ride-sharing giant Uber, for example, reportedly processes its payments through subsidiaries in the Netherlands, shielding the company from US taxes.

Sanger noted that Canada’s federal government has done little to pressure other OECD countries into introducing tougher global tax regulations, adding that “fundamental changes” are needed to address corporate and individual tax avoidance.

“There are things that Canada can do on its own, just as other countries have done,” he said.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate