No, Fraser Institute: The ‘Average Family’ in BC Will Not Pay $1,000 More Per Year in Taxes

The Fraser Institute’s sensational claims about taxes appear to be at odds with the data in its own report

The Fraser Institute strikes again – this time, sending out press releases that don’t reflect the findings of their own report on British Columbia’s tax code.

The right-wing think tank issued an alarming press release this week declaring that “BC government tax changes will cost (the) average family nearly $1,000 per year.”

The research bulletin examines tax changes introduced by BC’s NDP government, which include the popular speculation tax, surtax increases on luxury real estate, and an employer health tax.

Although the Fraser Institute’s research consistently fails to stand up to basic fact-checks, some of BC’s biggest media outlets like Global News and The Province passed along the right-wing think tank’s dubious findings without a critical lens.

A closer look reveals the Fraser Institute’s claim that the “average” BC family will pay $1,000 more in taxes is not only wrong – their own report says otherwise.

Here are a few reasons why the the Fraser Institute’s claims don’t add up

“Average families” do not earn nearly as much as the Fraser Institute suggests

For one thing, the report suggests “the average family’s tax bill will increase by a total of $959, not including tax increases on residential properties.”

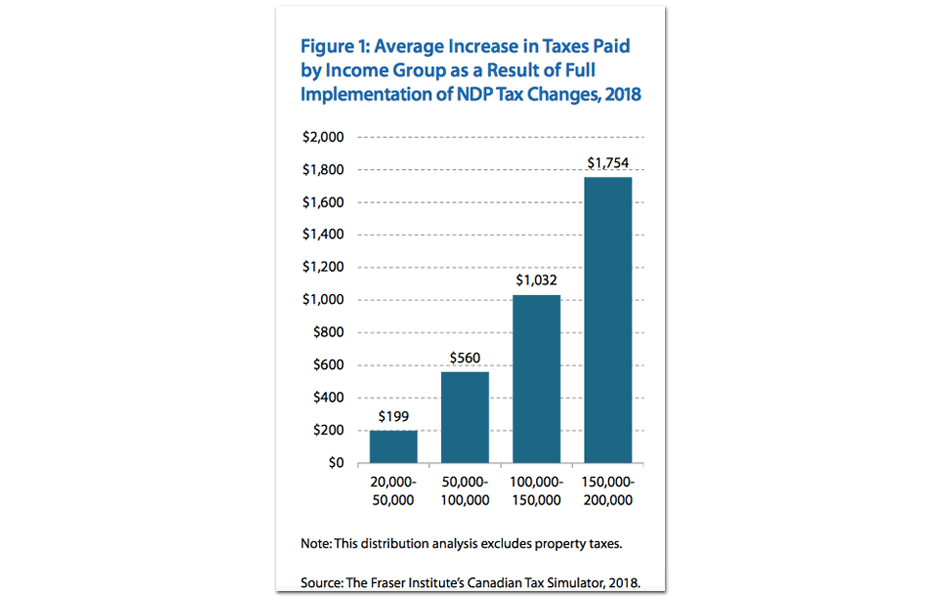

However, the report’s own data reveals that only families with a household income between $100,000 and $150,000 would pay $1,032.

Families earning between $50,000 and $100,000 would only pay $560, whilst those earning between $20,000 and $50,000 would only pay $199.

Fraser Institute

For the so-called “average family” to be taxed at around $1,000 per year it would need to be earning more than $100,000 per year – a whopping 20% higher than the actual median household income, according to the most recently available data.

The Fraser Institute tries to pass off business taxes as taxes on families

The Fraser Institute’s report imagines all taxes – including taxes on businesses and employers – as part of the tax bill of an “average family.”

In addition to counting a tax on luxury cars valued at over $125,000 and a tax on real estate worth over $3 million on the tax bill of the “average family,” the right-wing think tank also quietly includes corporate income taxes and other taxes paid for by employers.

Or take the Employer Health Tax as another example– that’s a tax introduced by the BC government to eliminate Medical Service Premiums. The Fraser Institute shifts the entire cost of that tax onto the bill of the “average family” without factoring in the $1,800 per year which most families in BC will save as a result of cutting the old Medical Service Premiums.

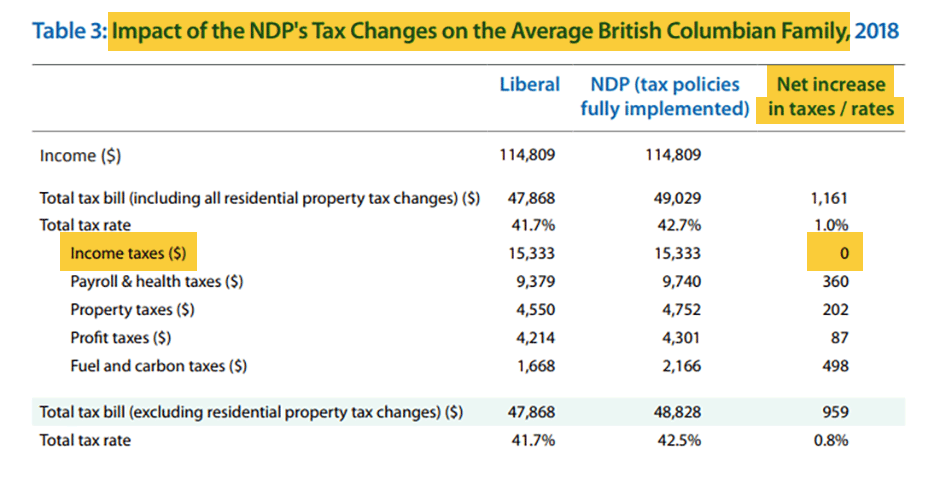

Fraser Institute admits income tax increased by 0%

Most staggering of all, the report’s summary claims that the BC government’s tax changes have led to “increases in personal income taxes.”

However, the report’s own data tells a very different story:

Fraser Institute

That’s right. Zilch.

Despite claiming personal income taxes are going up, the Fraser Institute’s own data shows personal income taxes in BC didn’t increase by a dime.

So, for “average families,” or those earning just above $81,000 per year (based on the most recent data available for median family incomes in BC), all of the supposed “tax increases” come from indirect sources – the “$1,000 per year” figure is based on nothing more than the Fraser Institute’s fuzzy math and dubious assumptions.

So, let’s recap:

- The Fraser Institute claims the “average family” in BC will be paying $1,000 more in taxes. Except the Fraser Institute’s own calculations show only families in the top two highest income brackets would be paying around $1,000 more per year — these are not “average families.”

- Many of the “tax increases” the Fraser Institute claims the “average family” pays are actually taxes on businesses, not families.

- Even though the Fraser Institute claimed personal income taxes are going up, their own report shows individual income tax didn’t increase at all.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate