VIDEO: If he becomes Prime Minister, Maxime Bernier might switch Canada back to the gold standard

Wouldn’t it be nice if Canada’s 21st century economy worked more like a 19th century economy? It appears Maxime Bernier, who’s kicking off his bid to become Conservative Party leader on Sunday, thinks so. In fact, the Conservative leadership hopeful and occasional blogger says he’s very much open to the idea of linking Canada’s currency […]

Wouldn’t it be nice if Canada’s 21st century economy worked more like a 19th century economy?

It appears Maxime Bernier, who’s kicking off his bid to become Conservative Party leader on Sunday, thinks so.

In fact, the Conservative leadership hopeful and occasional blogger says he’s very much open to the idea of linking Canada’s currency to the gold standard – a practice abandoned nearly a century ago.

“In most countries, money was linked to gold until the First World War, which means that the quantity of money increased at the same rate as the quantity of gold,” Bernier explained in a 2010 installment of his video blog.

Although John Meynard Keynes, one of the 20th century’s most influential economists, called “the old-fashioned gold standard” a “barbarous relic” of the past, Bernier suggested restoring the gold standard could bring about a return to “the most prosperous periods of human history”:

“The 19th century was one of the most prosperous periods of human history thanks to this system. Prices tended to go down instead of constantly going up. The level of debt of countries and households was under control. Economic crises were short-lived. More and more economists believe that the gradual relinquishing of the gold standard during the 20th century was a mistake, a mistake which brought about the Great Depression, the inflation of the 1970s, and the recessions that keep afflicting us.

I agree. I agree with this analysis. To return to a stable and sustained economic growth, we need to bring back stability to our money, and in the history of civilization, gold and silver always served as anchors to monetary stability.”

Of course, there may be a few wrinkles in Bernier’s theory.

For one thing, although Bernier imagines the 19th century under the gold standard as a period of stability and prosperity, the late 19th century was pretty volatile, with financial panics in 1873, 1884, 1890, 1893 as well as a “Long Depression” between 1873-1879.

The 19th century was also marked by widespread poverty, destitute living conditions, crummy labour standards and other things you may have read about in a number of Charles Dickens novels.

Speaking of human misery, the gold standard was still in place when the Great Depression began in 1929, so if Bernier believes the “relinquishing of the gold standard” actually “brought about the Great Depression,” he may need to elaborate on how he sees cause-and-effect working here.

Canada got rid of the gold standard in 1933, the United Kingdom did so two years earlier, and the United States also ended the gold standard in 1933 (a version of the gold standard was reinstated after the war, but that too was ended in 1971).

The gold standard also created not-so-stable booms and busts: the gold rushes of the 19th century, to name one example.

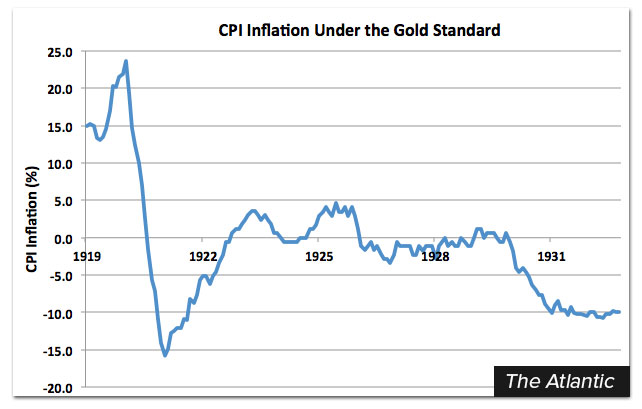

And as The Atlantic‘s Matthew O’Brien points out, prices weren’t exactly stable under the gold standard either:

“Prices can change violently under the gold standard, as the balance of trade changes or the physical stock of gold changes. Remember, price stability isn’t just about avoiding inflation; it’s about avoiding deflation too. The gold standard wasn’t good at either.”

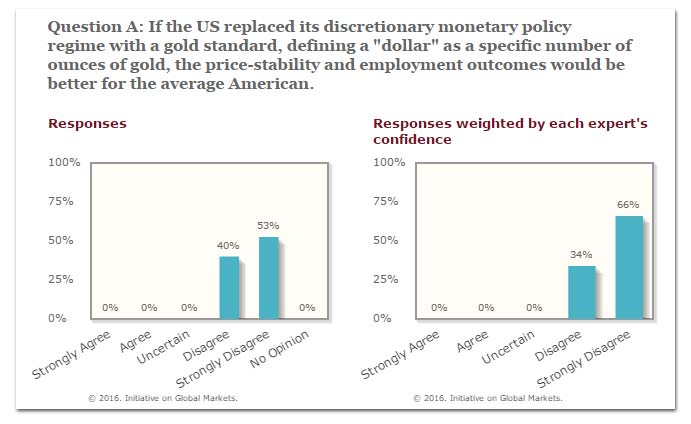

As for his claim that “more and more economists” agree that the “relinquishing of the gold standard” was a “mistake,” it’s not clear to which economists Bernier is referring.

According to a 2012 poll of 40 top American economists, including past economic advisers to Republican and Democrat presidents, precisely 0% agreed that switching to the gold standard would be in any way good for “the average American.”

Weighted for each economic expert’s level of “confidence” in their answer, 66% “strongly disagree” restoring the gold standard would be a good thing, while the remaining 34% simply “disagree” that it could be a good idea.

“Eesh. Has it come to this?” remarked former White House economic adviser Austan Goolsbee in a supplementary comment.

Photo: aloha75, youtube. Used under Creative Commons Licenses.xxxx. Used under Creative Commons license. Conservative Party of Canada.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate