Ford Government Will Claw Back Even More Money From Struggling Ontarians and Low-Income Parents: Report

New calculations show the average recipient of social assistance will end up poorer thanks to recent changes by the Ford Government

Many struggling Ontarians who rely on social assistance will have less money in their pockets once the Ford government’s Ontario Works changes come into effect, a new update by the HIV & AIDS Legal Clinic Ontario says.

According to HACLO, social assistance recipients that have net earnings above just $500 per month “will have less total income” starting on November 1.

Last fall, social assistance recipients were supposed to see the rules changed that would allow them to keep up to $400 per month without triggering clawbacks in their assistance — but the Ford government decided to cut that to $300 and raised the clawback from 50% to 75% of every additional dollar earned.

For example, those living well below the poverty line with a monthly income of $1,000 will now see $525 deducted from their monthly assistance.

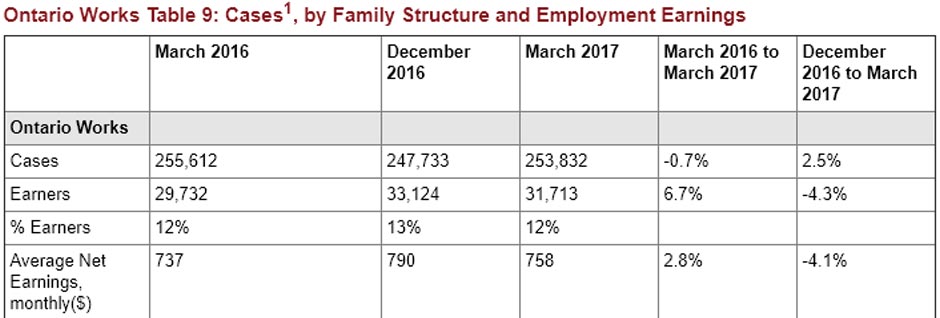

While it’s unknown exactly how many social assistance recipients earn above $500 per month, the ministry’s own data shows that as of March 2017, the average OW recipient brought in $758 in monthly employment earnings.

And, while the average single adult recipient reported $574 in monthly net earnings, the average couple without children reported income of $873 per month.

Couples with children, the largest group making up one-quarter of all recipients in Ontario, reported $1,053 in monthly net earnings while single parents reported $852 in monthly earnings.

Ontario Ministry of Children, Community and Social Services

According to HALCO’s calculations, the average person in each of these groups will be left worse-off.

HALCO community legal worker Jill McNall told PressProgress “The new rules will mean that many people on OW/ODSP who work will be poorer than they were before. And many will be below any credible poverty line.”

The changes also expand the pool of recipients affected. Instead of only impacting recipients who have been in the system for three months, now all recipients will see the change after only one month.

Additionally, HALCO notes, the system sets the recovery rates in cases of overpayment at 10%. That means if a person receives more support than they qualify for, the person’s support is reduced 10% until the “overpayment” is paid off. HALCO notes, further, “the 10% deduction rate may also be applied in some other circumstances, including when OW/ODSP takes the position that the recipient has the ability to afford a 10% deduction.”

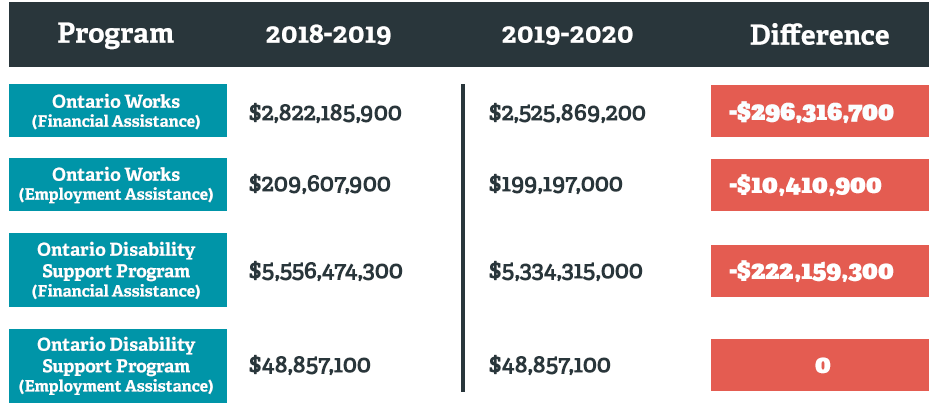

It is not yet known how childcare and disability-related expenses will change. But, according to 2019-20 budget estimates, the government is expecting to massively reduce both OW and ODSP financial support in the coming year.

Chart: PressProgress

The office of Children, Community and Social Services Minister Todd Smith did not respond to multiple requests for comment from PressProgress.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate