BC News Outlets Exaggerated the Cost of Public Car Insurance. Their Numbers Came From a Big Insurance Lobbyist.

Pro-privatization insurance lobbyist inflated average auto-insurance figures by 30%, analyst says

Recent headlines claiming BC has the “highest auto insurance premiums in Canada” are based on inaccurate data supplied by a big insurance lobbyist that wants to privatize BC’s public auto insurance agency, a new report says.

Major news outlets, including CBC News and Global News, recently reported “British Columbians pay an average of $1,832 for car insurance per year,” allegedly “the highest auto insurance premiums in Canada.”

Both news organizations credited that number to the General Insurance Statistical Agency, the statistical agency run by Canada’s provincial insurance regulators.

Except there’s one small catch: GISA does not publish data on average BC premiums.

“As the Province of British Columbia does not participate in GISA, data is not collected or published related to insurance market in British Columbia,” a GISA spokesperson confirmed to PressProgress.

In fact, the numbers cited by CBC and Global originally came from a press release put out by the Insurance Bureau of Canada, an industry association representing Canada’s private home, auto and business insurers.

While Global at least noted the lobby group supplied them with the GISA numbers and “strongly favours private car insurance,” CBC did not.

Aaron Sutherland, IBC’s Vice-President, admits the BC data didn’t come from GISA, it filled in the gaps using data from a different source.

“Did GISA do this? Well, no, because nobody does it for BC,” Sutherland confirmed to PressProgress.

“It’s just using GISA’s methodology.”

GISA’s spokesperson expressed caution at combining its data with public data from other jurisdictions since “there are many complexities that need to be considered when comparing jurisdictions, including the design of each jurisdiction’s insurance system.”

Richard McCandless, a policy analyst and former senior public servant, says the lobby group inflated BC’s average annual premium 30% higher than it really is.

In a BC Policy Perspectives paper, McCandless says the lobby group took data on provinces with no public insurer from GISA and combined apples with oranges by adding different data from ICBC which does not factor in the costs of premiums for extended coverage plans provided by private insurers in BC.

McCandless says BC drivers pay average annual premiums of $1,390 — not $1,832.

And BC motorists actually receive more “generous” coverage than drivers in private jurisdictions.

IBC’s figures also ignore the fact BC’s public auto insurance provider funds a road safety program that private basic insurance providers in other provinces don’t have to pay for.

“The IBC and Canadian Taxpayers Federation focus on the price ignores these important coverage issues,” McCandless told PressProgress.

“The Saskatchewan, Manitoba and Quebec compulsory third-party liability models do not allow claims for pain and suffering, but have much higher limits on medical, rehab and wage loss compared to the private jurisdictions.”

Sutherland and McCandless have debated eachother’s approaches in a published email exchange.

McCandless says IBC is keen to make British Columbians drivers think they pay more in car insurance premiums to justify privatizing car insurance.

“The IBC is the lobby group for the private insurers,” McCandless said. “Its agenda is to convince the BC Liberals – if they become government again – to open the compulsory auto insurance to private firms.”

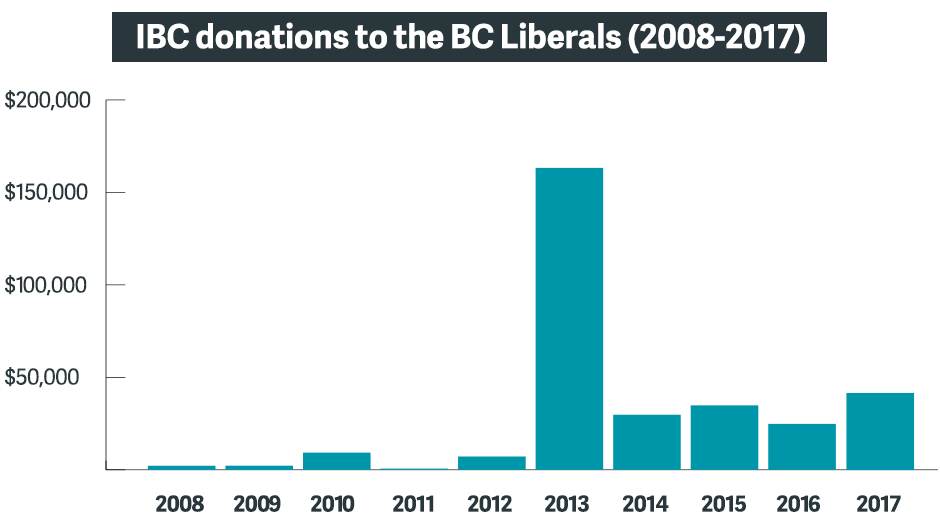

The BC Liberals, who took $180,000 in donations from IBC between 2008 and 2017, also promoted the lobby group’s debunked car insurance numbers on Twitter.

Elections BC

In recent months, IBC launched a campaign against ICBC, which entered financial difficulties after the old BC Liberal government re-allocated funds from the crown corporation to balance the government’s books in other sectors.

That mess, dubbed a “financial dumpster fire” by Attorney General David Eby, caused ICBC’s basic premiums to increase by 6.3% in 2019.

BC Liberal leader Andrew Wilkinson called for the privatization of ICBC during his party’s convention last year.

However, studies warn relying on private insurers to provide basic coverage would result in discriminatory premium rates, higher rates of uninsured drivers and poorer quality coverage.

Chuck Byrne, head of the BC Brokers Association, recently said he supported ICBC’s universal coverage system because it provides stability for auto-insurance coverage:

“Universally available coverage and limits, not a free-for-all of profit-seeking competition, is what provides stability to the societal dilemma of auto insurance. The private insurers and their never-ending battle with government and regulators in other provinces is not the model B.C. or Saskatchewan, Manitoba, or Quebec should aspire to. Been there… suffered that.”

Correction: Citing our previous reporting, this story originally noted IBC made $175,000 in donations to the BC Liberals between 2008-2017. More recent data from Elections BC indicates IBC’s donations to the BC Liberals totalled $180,000.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate