5 Deceptive Claims Andrew Scheer’s Conservatives are Making About Small Businesses and Taxes

Andrew Scheer's Conservatives have a new video attack ad. But it isn't exactly accurate.

Conservative leader Andrew Scheer has released a new video attack ad as part of a new campaign targeting the Liberal government’s proposed changes to small business tax rules to prevent abuse by wealthy tax filers.

Are the Conservatives’ claims accurate?

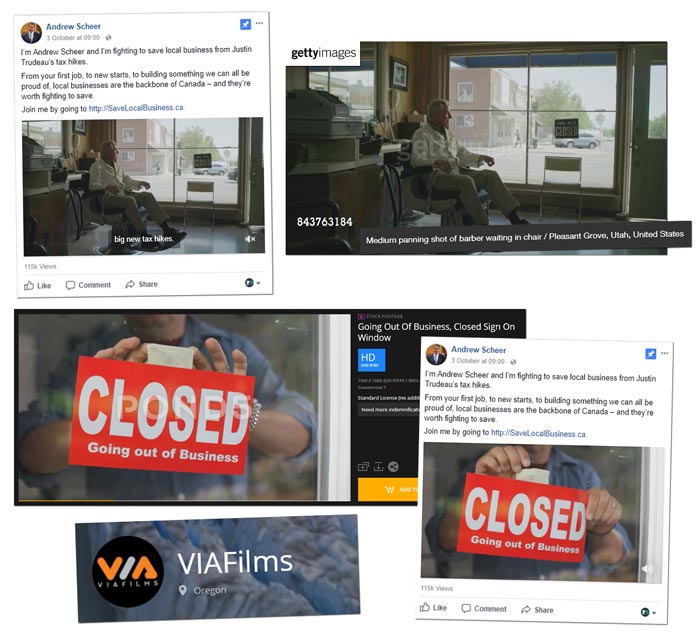

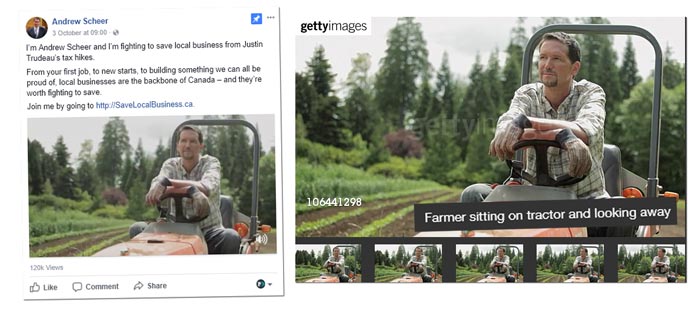

Considering the new attack ad tries to pass off stock footage of struggling business owners from Utah and Oregon as Canadian business owners, it might make you wonder what else Scheer’s Conservatives aren’t telling us?

Looking closely at their claims, here are a few other things Scheer’s Conservatives got wrong:

They claim closing tax loopholes for wealthy Canadians will hurt mom-and-pop shops on Main Street

“Local businesses are the backbone of Canada,” the Conservatives claim, speaking nostalgically about “the coffee shop down the street, and the bar where you catch up with your friends at the end of the week.”

Except what Scheer’s Conservatives won’t tell you is very few mom-and-pop shops will actually be impacted by the changes – it’s estimated only 13% of small businesses currently take advantage of income splitting, a tax loophole the Liberal government has pledged to fix.

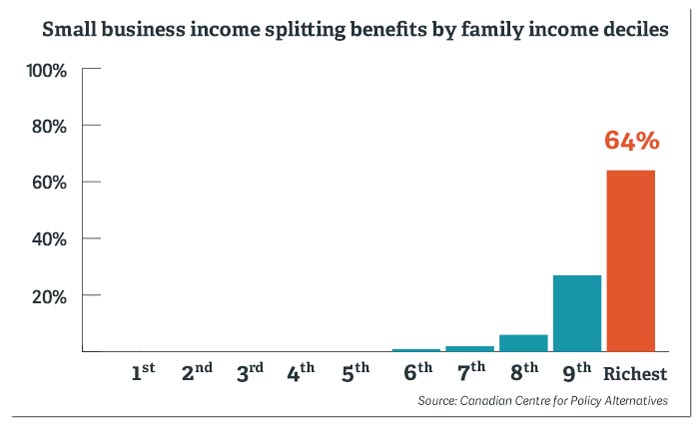

According to the Canadian Centre for Policy Alternatives, “the benefits of small-business income splitting are heavily skewed to Canada’s richest families,” noting “almost two-thirds (64%) of benefits from small-business income splitting flow to families making more than $168,000 in combined pre-tax income.”

The CCPA estimates these benefits, narrow as they are, cost federal and provincial governments $840 million in lost revenue each year.

They claim closing tax loopholes will “make life harder for farmers”

The Conservatives also claim the changes will “make life harder for farmers.”

Except these changes are more likely to make life harder for lawyers and tax accountants than someone who runs a family farm – benefits from “income sprinkling” are heavily skewed towards Canada’s richest families rather than working families.

As a recent report from the CCPA found:

“Of the 904,000 families receiving small business dividends, only about 47,000 (5%), representing 0.3% of all Canadian families, are likely to see more than $1,000 in tax savings from income sprinkling. In contrast, those we might normally call middle class – families whose incomes put them in the middle 40% of all income deciles – receive only 3% of the benefits from the current income-sprinkling loophole. By far the biggest winners are Canada’s top 10% of families by income, who have access to nearly two-thirds of the total tax benefit from the current loophole.”

The report adds that those who run family farms or restaurants are “2.5 times less likely than professionals to benefit from income sprinkling”:

“On the other hand, more traditional small businesses, such as family run farms or restaurants, are 2.5 times less likely than professionals to benefit from income sprinkling. Even among health care businesses – the group most likely to benefit from the current sprinkling loophole – three-quarters of families see little or no tax gain from distributing dividends among family members.”

They claim closing tax loopholes will “increase health care wait times”

The Conservatives are also distributing flyers claiming the tax changes will “increase health care wait times.”

The flyers don’t indicate who their source for this information is, although the claim appears to be based on a recent survey released by a group called “Concerned Ontario Doctors,” described as “the most militant faction within the Ontario Medical Association.”

The Ottawa Citizen suggests no one should believe the survey.

The group makes the incredible claim that “Ontario will lose two-thirds of its doctors” triggering “the collapse of our health-care system” if the Liberal government fixes a tax loophole involving the use of private corporations.

What the group doesn’t mention is the “survey” was actually e-mailed to their own supporters and claims an implausible margin of error that “real pollsters” would need to spend “a tonne of money on thousands upon thousands of calls” to achieve.

They claim closing tax loopholes will “cause layoffs” and “force manufacturing plants to close”

The Conservatives also warn the tax changes will “cause layoffs” and “force manufacturing plants to close,” but once again, they offer no evidence to support their claims.

It seems the Conservatives are relying on anecdotal statements from business lobbyists like the Council of Canadian Innovators or the Canadian Federation of Independent Business, who claim business owners are “telling us” closing these loopholes “could hurt employment” as “business owners look for other ways to offset the added costs to themselves.”

Except these groups are hard pressed to offer hard numbers or concrete evidence to support their claims.

They also fail to mention “Ottawa’s changes are specifically designed not to apply to investment income which is re-invested in the company,” as Vice News recently noted. In other words: “if the revenue goes into hiring workers or buying equipment, it is either tax exempt or the tax will be refunded,” meaning the changes could actually be more effective at spurring investment and creating jobs.

What’s more, recovering revenue lost to tax loopholes also allows governments to invest in infrastructure and public services, which also stimulates economic activity and creates jobs.

“The economic impact of tax breaks for the wealthy is about 50 cents on the dollar, while government spending on things like daycare and infrastructure like public transit is more like a $1.50 for each dollar of spending,” Dennis Howlett of Canadians for Tax Fairness told PressProgress.

One other thing the Conservatives’ business lobbyist allies fail to point out: Canadian small businesses currently enjoy the lowest tax rate anywhere in the G7.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate