4 things Stephen Harper gets dead wrong about corporate taxes

Stephen Harper would like you and your loved ones to be very, very scared about corporate taxes!

Stephen Harper would like you and your loved ones to be very, very scared about corporate taxes!

According to the Conservatives and others opposed to raising the corporate income tax (CIT) rate so Canada can invest in other areas, the apocalypse awaits us all if Corporate Canada’s taxes on their profits go up by two percentage points to 17%

And to really underline their point, the Conservatives used this image below of a distraught woman who looks like she is experiencing a really uncomfortable skin rash. Ouch!

Except what the Conservatives don’t mention is the corporate tax rate was 22% under the Conservatives in 2007 and also 18% in 2010, both of which are higher than raising the CIT rate from 15% to 17%.

Harper’s hysteria is based on a study by right-wing economist Jack Mintz, who actually argues that the corporate income tax rate should be cut another 2% (from 15% to 13%). Raising it by that same number to 17%, argues Mintz, would cost the economy 150,000 jobs.

Unfortunately for Mintz – whose share holdings from sitting on two corporate boards (Imperial Oil and Morneau Shepell) are valued at $1.86 million – the evidence tells a different story.

1. Corporate taxes are one of many factors creating or killing jobs

Mintz himself admits corporate tax rate is one of many factors influencing whether jobs will be created or lost.

“Various factors affect investment besides taxation,” Mintz said in an opinion piece earlier this year, “including growth in demand for goods and services.”

“The amount of jobs that (a tax increase) creates or loses is dwarfed by everything else that is going on in the economy,” agreed Ivey Business School professor Mike Moffatt.

2. Raising corporate taxes creates jobs too

Mintz’s claims about corporate taxes have been responded to widely here, here, here, here, here, and here.

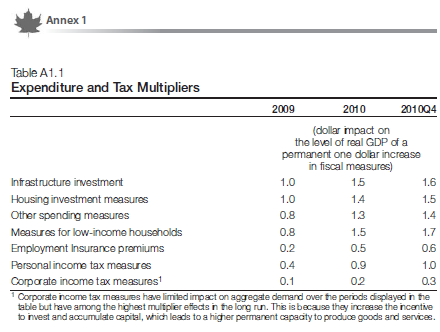

One thing Mintz doesn’t take into account is the “multiplier effect” of corporate tax revenues and the spending they pay for.

In other words, the increased revenue collected in corporate taxes doesn’t simply vanish into thin air: it gets invested in things like public transit and childcare. That creates jobs and is a smarter investment than a tax-giveaway.

The Conservatives’ own 2009 budget took into account this very same CIT multiplier effect on page 240:

3. Corporate tax cuts have failed to stimulate investment

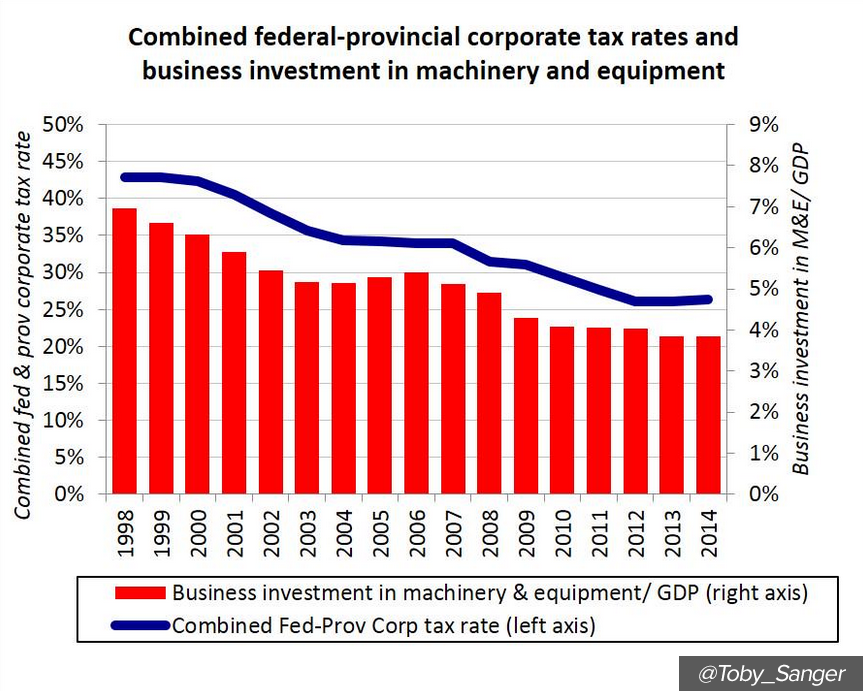

In 1998, the combined federal and provincial CIT was over 40%, with business investment in machinery and equipment at about 7% of GDP. Since then, both federal and provincial CITs have been steadily cut.

At the federal level, the Liberal government slashed the CIT rate from 28% in 2000 to 21% in 2004, and Harper continued the trend, cutting them down to 15% by 2012.

And what have Canadian corporations been doing with their cash? They’re sitting on record levels of it on their balance sheets and Canada ranks last in business investment in R&D.

This is what that investment looks like:

Far from stimulating it, business investment in machinery and equipment has fallen to less than 5% of GDP.

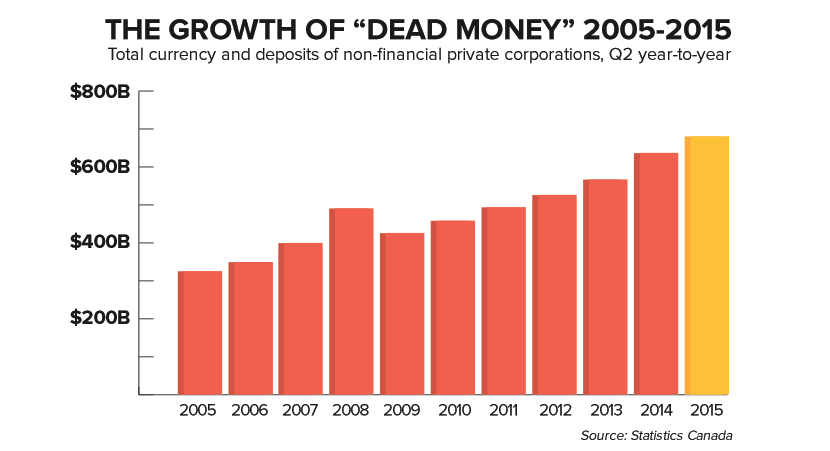

What’s more, Corporate Canada’s hoard of “dead money” has more than doubled since 2005, earning Canada criticism from the IMF, which warns the idle piles of cash mean “Canadian firms may be missing on productive investing possibilities.”

What was that about corporate tax cuts stimulating investment again?

4. Cutting corporate taxes costs Canada billions annually

While insisting that raising corporate taxes will have a massive impact on employment, right-wingers like Mintz argue in the next breath that it won’t actually do very much.

Mintz argues that a 2% hike of the federal CIT won’t generate the revenue its proponents expect. In 2010, he claimed that reducing the CIT from 18% to 15% would have a “relatively small” impact on the revenue generated for government.

But according to the non-partisan Parliamentary Budget Officer, cuts to the CIT between 2006 (set at 22.1%) and 2015 (cut to 15%) have cost the federal treasury an estimated $12 billion annually.

The result has been a huge loss of public revenues with no meaningful economic gain.

Photo: Conservative Party of Canada.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate