UCP’s Corporate Tax Cuts Could Let Five Companies Alone Reduce Public Revenues $4.3 Billion

But there's no money for education, health and social services

Albertans are just at stage one of the United Conservative Party’s corporate tax cut plan — but reports show five companies alone are already projecting $4.277 billion in “savings.”

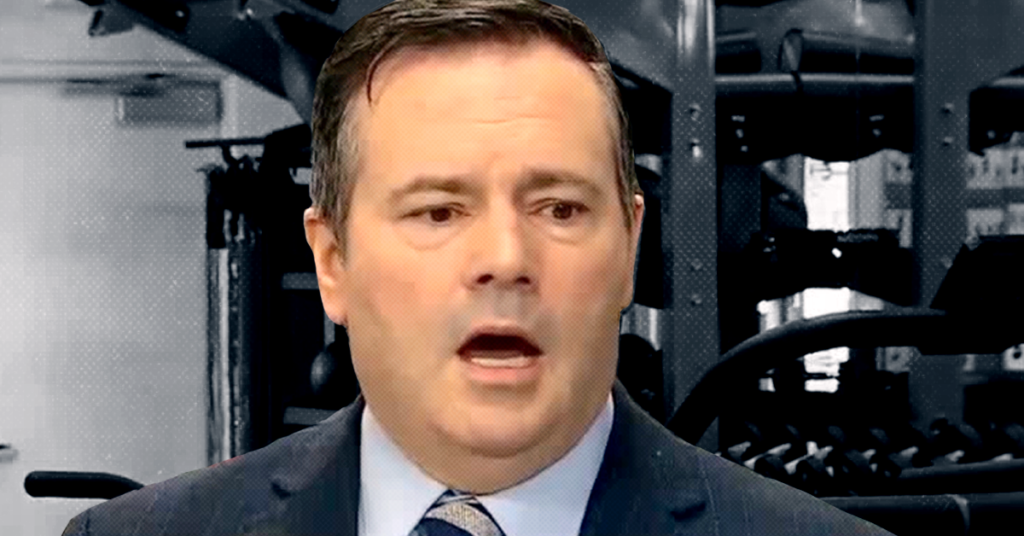

The reduction was followed by a budget that included cuts to health, education, social programs and more, so deep one expert warned could they trigger a “Kenney recession.” According to Premier Kenney, these cuts are necessary because the province is “broke.”

While campaigning, the current opposition warned Kenney’s corporate tax cut could blow a $4.5 billion hole in public revenues “over four years.”

But reports from just five of Alberta’s top companies themselves suggest the likely drop in revenue is larger than that.

An analysis of Alberta’s ‘big five’ energy companies, which remained remarkably profitable even during the oil price crash that saw almost 20,000 workers laid off, finds these companies alone expect to save a combined $4.277 billion, thanks to the tax cut.

Canadian Natural Resources expects to save the most from the tax cut — $1.618 billion.

In its second-quarter report, CNR told stakeholders:

“In the second quarter of 2019, the Government of Alberta enacted legislation that decreased the provincial corporate income tax rate from 12% to 11% effective July 1, 2019, with further 1% rate reductions every year on January 1 until the provincial corporate income tax rate is 8% on January 1, 2022. As a result of these corporate income tax rate reductions, the Company’s deferred corporate income tax liability decreased by $1,618 million.”

Suncor Energy, meanwhile, is projecting to save $1.116 billion.

The company similarly described these savings as being “associated with the Government of Alberta’s substantive enactment of legislation for the staged reduction of the corporate income tax rate.”

Imperial Oil is also projecting $662 million in corporate tax savings. The company attributes this to “the favourable impact associated with the decreased Alberta corporate income tax rate.”

The fourth-biggest winner is Cenovus energy. Cenovus wrote, in its June 30 financial statement, it is looking at $658 million in savings “as a result” of the UCP’s corporate tax cut.

Finally, Husky Energy, which recently laid off hundreds of workers in Calgary while expanding its investments outside the province, is also anticipating sizable savings from the tax cut.

In its Q3 report, Husky listed “the recognition of $233 million in tax recoveries related to the reduction in the Alberta provincial corporate tax rate that was substantively enacted in the second quarter of 2019.”

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate