Pay Gap Between CEOs and Canadian Workers Just Hit a ‘New All-Time High’

Top CEOs now making 243 times more than the average Canadian worker

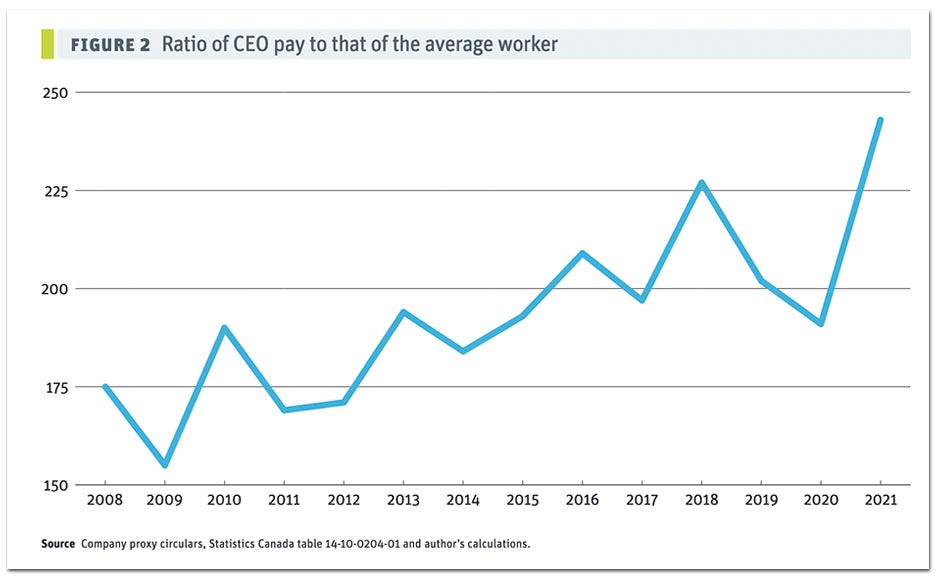

The pay gap between Canada’s top CEOs and average Canadian workers is wider now than it’s ever been before.

According to a new report from the Canadian Centre For Policy Alternatives, the 100 highest paid CEOs in Canada were paid a staggering 243 times what the average Canadian worker took home last year.

“While inflation has hammered consumers, average top CEO pay hit $14.3 million

in 2021, smashing the previous record of $11.8 million in 2018 and setting a

new all-time high in our data series,” the CCPA’s report notes.

“The richest CEOs made 243 times more than the average worker — an all-time high.”

With top CEO pay having doubled since 2008, it rose to a record high of 243 times the pay of average private sector workers – up from 227 times that of the average worker in 2018.

Ratio of CEO pay to that of the average worker (CCPA)

In 2021, against year-over-year inflation of 4.8%, average private sector pay rose by just 3%, at the same time as Canada’s richest 100 CEOs saw their pay rise 26%.

“Workers have taken a 2% pay cut when you factor in inflation and CEOs have seen a 26% pay increase,” CCPA economist and report author David Macondald told PressProgress.

All told, CEOs have profited while inflation has eroded workers’ pay –the report observes “inflation is driving record-breaking profits, which are driving CEO pay.”

“Inflation is higher prices,” Macdonald said. “With higher prices you start to see higher corporate profits.”

As CEOs are paid largely in bonuses and stock options, Macdonald noted these compensation figures were elevated by booming corporate profits. In fact, in the second quarter of 2022, after-tax profits accounted for a record-setting 18.3% of Canada’s GDP.

“Anybody looking at this list is going to see who is on there. All the big banks? The CEOs are on there. The place where you buy your groceries is on there, the place where you buy your gas,the mining companies, they’re all on there,” Macdonald said. “It’s a who’s who of corporate Canada.”

The CEOs on Canada’s top 100 list include Alimentation Couche-Tard CEO Brian Hannasch who saw his compensation total $12.825 million, Galen Weston jr. at $10.606 million, TC Energy CEO François Poirier at $9.813 million, Gildan Activewear CEO Glenn J. Chamandy at $14. 556 million, Dollarama CEO Neil Rossy at $ 7.831 million, Empire Company CEO Michael Medline at $7.491 million and others.

“Inflation isn’t necessarily going to lead to higher profits. It may mean companies are getting squeezed, seeing higher input costs and passing them on to consumers. But that clearly is not the case in the aggregate,” Macdonald said.

“When companies are planning price increases for future years, one of the concerns is they factor in past price increases from past years. In so far as that happens in cases where there is not a lot of competition keeping prices down, you end up creating inflation through expectation from companies that prices are going to rise.”

University of Toronto economic professor Gustavo Indart said the data shows “firms have been taking advantage of their market power in an inflationary environment.”

“Firms raised prices in excess of what was needed to cover higher costs in order to increase their profits – and that’s why corporate profits increased dramatically in 2021,” Indart told PressProgress.

Correction: A typo in the sub-headline of this article mistakenly stated that top CEOs made 234 times more than the average Canadian worker. In fact, as the article itself noted, CEOs made 243 times more than the average Canadian worker.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate