It’s official: Canada’s richest CEOs pocketed the average worker’s annual income before lunch today

Are Canada’s high-rolling corporate bosses really 209 times more valuable than the rest of us?

Did someone say the economy can’t afford a $15 an hour minimum wage?

As many Canadians return to work for the new year, a new report by the Canadian Centre for Policy Alternatives’ David Macdonald finds the country’s top 100 CEOs banked the average worker’s annual salary before lunchtime today.

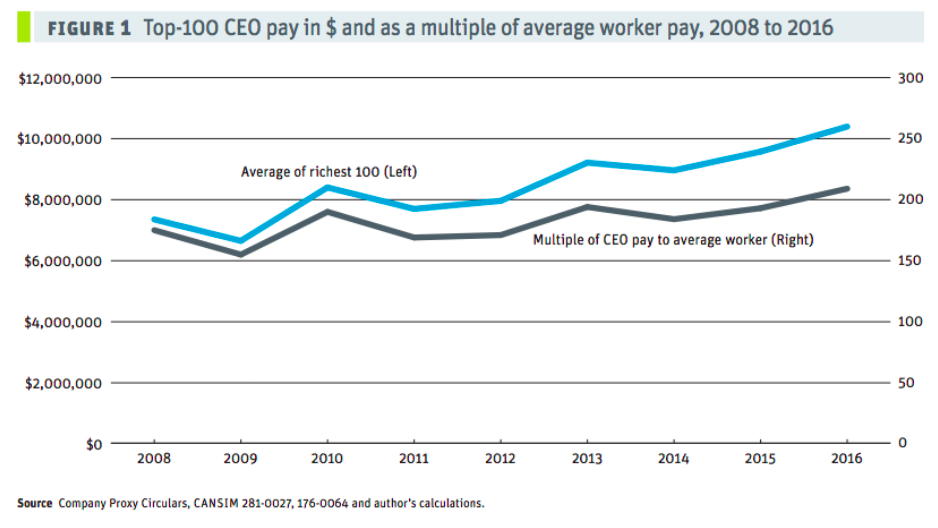

According to the latest data, in 2016 Canada’s most lushly-paid executives made an average of $10.4 million— or 209 times the average income of $49,738.

In the CCPA’s 11 years of analyzing CEO wage data, this marks the first time CEO to average worker pay has surpassed a ratio of 200:1.

As MacDonald points out:

“The growing gap has been a consistent reminder that there is enormous wealth circulating through the economy—it is simply not making its way into the hands of the average worker.”

Worse, as CEOs were putting away even more the average worker’s pay actually declined.

“In 2016, average worker pay rose by 0.5%—a $228 bump from $49,510 to $49,738—meaning that in real terms the average income has fallen once inflation is taken into account. Canada’s top 100 CEOs, on the other hand, saw an average pay hike of 8%—from $9.6 million in 2015 to $10.4 million in 2016.”

Perks and loopholes: The CEO pay bonanza

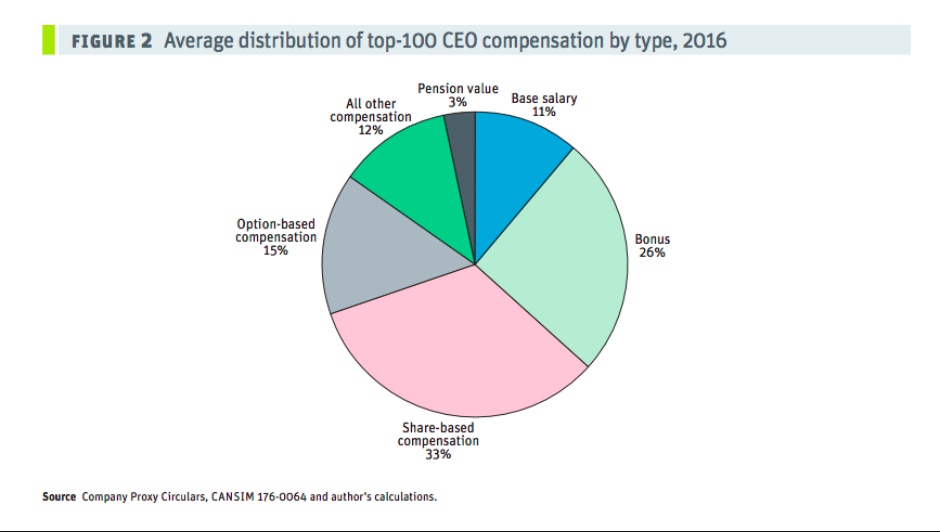

For most workers, calculating earnings is pretty simple: they’re paid out through a salary or calculated by way of an hourly wage.

But if you’re part of the elite CEO club, things are a bit more complicated. That’s because many high-ranking executives receive a substantial share of their earnings through means besides their base salaries, such as bonuses, shares, and stock options.

For example, while Joseph Papa of Valeant Pharmaceuticals International (Canada’s highest paid CEO) earned a base salary of $1,299,990 in 2016 he also received an additional $12,095,005 in bonuses, $55,662,745 in shares, and some $13,254,809 in stock options.

And if that somehow weren’t enough, his stock option earnings won’t even be taxed at the full rate. Stock options offer executives the option to buy a given number of company shares at a predetermined price and profit from the difference when their value rises. And in Canada, only 50% of that income is subject to tax.

While the Trudeau Liberals campaigned on closing the loophole, estimated to cost as much as $750 million a year, they flip-flopped on the promise following pressure from Bay St.

Given the scale of the problem, and increasing importance of shares and other perks in CEO compensation, Macdonald argues that a comprehensive overhaul of the tax system is needed:

“It is unlikely that any one measure—to increase transparency in executive compensation, for example, or make minor changes to tax measures—will curtail overall growth in CEO pay. The government should therefore consider more comprehensive tax reforms, such as eliminating the capital gains partial inclusion on any share-based compensation granted to executives. This would have the double-benefit of increasing tax revenues, which could be put towards social programs that help everyone while reducing inequality, and improving CEO performance, which is currently skewed by the prevalence of stocks in overall compensation.”

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate