Canadians Believe Canada Revenue Agency Goes Too Easy on Wealthy Tax Dodgers, Internal CRA Report Says

Experts say CRA needs more auditors and resources to crack down on ‘complex’ tax schemes run by corporations and wealthy tax dodgers

An internal report prepared for Canada Revenue Agency suggests many Canadians believe ordinary people are subject to one set of rules on paying their taxes while wealthy individuals and corporations are held to a different standard.

And despite the Trudeau government’s pledges to crack down on tax cheats, the report suggests this has inspired little confidence that tax justice is being served – nearly half of Canadians believe these white collar crimes are still on the rise.

The public opinion research, prepared by Environics, was commissioned by Canada Revenue Agency to “explore Canadian public attitudes on the perceived prevalence of non-compliance among high net worth individuals and related entities.” The findings are based on a quantitative telephone” survey of 1,600 respondents.

“One of the of the core mandates of the Canada Revenue Agency (CRA) is ensuring that people and businesses appropriately report and pay the taxes that they owe,” the report states.

“Canada has one of the highest voluntary tax compliance rates in the world, but despite this there is a segment of high net worth individuals who use various strategies of tax avoidance and evasion to avoid paying what they owe.”

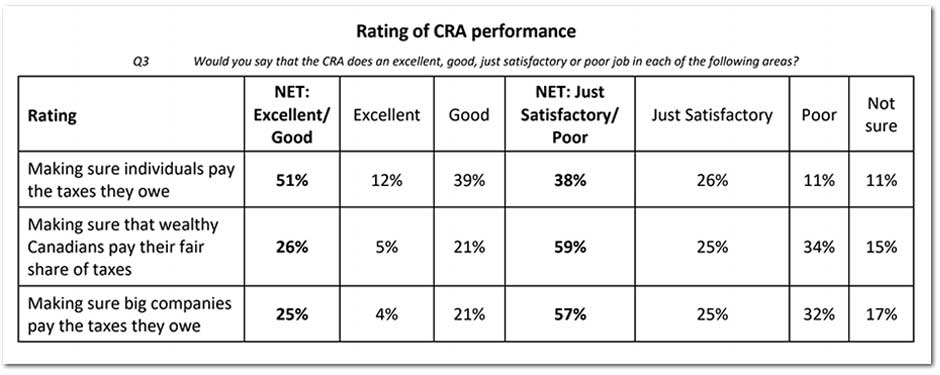

According to the report’s findings, half of Canadians (51%) believe “CRA does an excellent or good job at ensuring individuals pay the taxes they owe,” while only a quarter of Canadians feel the same about the job CRA does in ensuring “wealthy Canadians” (26%) and “large corporations” (25%) pay the taxes they owe.

In fact, one-third of Canadians say CRA does a “poor” job of enforcing the rules on wealthy individuals (34%) and corporations (32%).

Canada Revenue Agency

The report states “nine-in-ten agree that the CRA needs to pursue wealthy tax avoiders and evaders and eliminate the tax loopholes they use,” with 63% indicating they “strongly agree.”

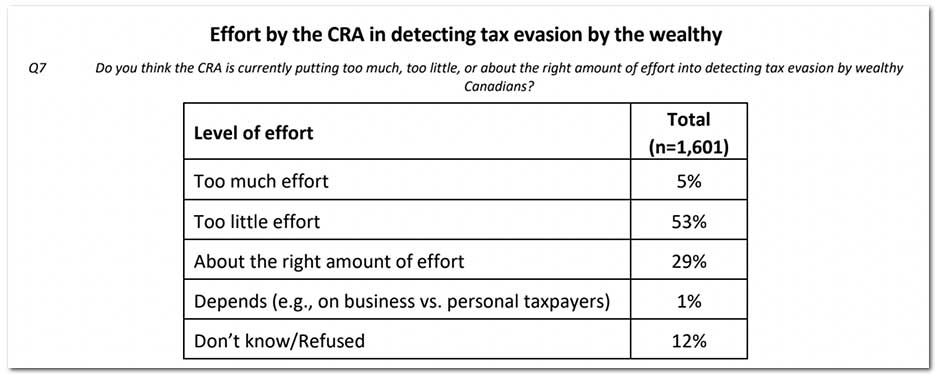

Yet half of Canadians (53%) said “CRA is putting too little effort into detecting tax evasion by the wealthy” compared to 29% who said “CRA is putting the right amount of effort into this” and 5% who said “CRA is doing too much.”

Canada Revenue Agency

After the former Harper Conservative government announced plans to eliminate thousands of positions at CRA, including auditors, the Trudeau Liberal government reversed course and announced a variety of measures aimed at cracking down on tax evasion and offshore tax avoidance, including more money for auditors.

Despite this, money flowing from Corporate Canada to offshore tax havens has set new records while CRA has struggled to investigate high profile leaks of offshore tax data included in the Panama Papers and Paradise Papers.

CRA has identified more than $76 million in taxes owed in connection to those tax haven leaks, but referred only five cases for criminal investigation – three of those cases were later dropped and only two were being pursued.

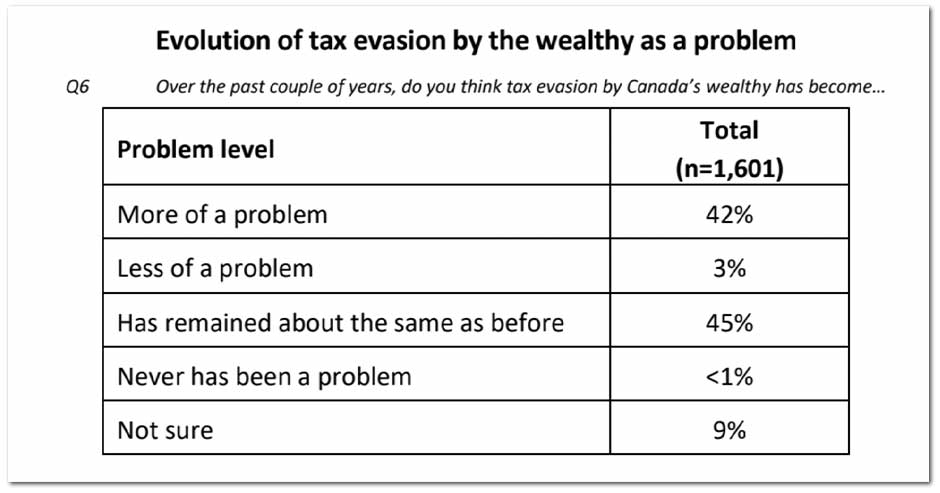

According to the CRA report, 42% of Canadians believe tax evasion by wealthy individuals has become more of a problem over the past couple of years and 45% believe it has stayed the same – only 3% of all respondents said it’s become less of a problem.

Canada Revenue Agency

DT Cochrane, an economist with Canadians for Tax Fairness, says the internal report underlines why “CRA needs more resources” to do its job.

“Tax avoidance by the wealthy is complex, especially when aided and abetted by creative accountants and tax lawyers,” Cochrane told PressProgress. “The auditors focused on high net worth tax filers need to be properly equipped to take on these complicated files.”

“While the Liberal government has hired more auditors and provided more funding to the CRA, the PBO found the extra funding does not actually return the agency to levels before cuts by the Harper government, once we adjust for inflation,” Cochrane said, adding “dedicated teams need to be given time to collaborate, learn best practices from international partners, and develop vital in-house tools and skills.”

Jennifer Carr, President of the Professional Institute of the Public Service of Canada which represents thousands of CRA auditors, says CRA’s research reinforces their calls for meaningful investments in the upcoming federal budget.

“By investing in tax professionals, bolstering the tools they have at their disposal to catch tax cheats, and by making smart tax policy choices, the government can find the necessary revenue to make life more affordable for ordinary Canadians,” Carr told PressProgress.

PIPSC points to lack of resources, including training, adequate technology and the number of auditors as the biggest obstacles in cracking down on wealthy individuals and corporations dodging taxes.

A PIPSC spokesperson noted the “federal government has not adequately increased the number of CRA auditors,” noting that “CRA hired approximately 550 new Auditors between 2019-2023 – an increase of 8.5%. This is less than the 11.8% growth in the Federal Public Service over the same period.”

According to PIPSC, every dollar invested in auditors brings back nearly $5 in tax revenue. A 2021 analysis by the Parliamentary Budget Office projected Canada would have generated $492 million in new revenue in 2023 if the federal government increased investment in CRA audit enforcement by $100 million.

In addition to a need for more auditors, Cochrane says CRA’s failure to respond to the kinds of tax schemes that came to light in high-profile leaks like the Paradise or Panama Papers are not only an “investigative and enforcement failure,” but also a “legal failure.”

Canadians for Tax Fairness wants to see the federal government update its General Anti-Avoidance Rule (GAAR) to help address violations of the spirit, if not the letter of the law. “It’s supposed to catch a lot of the creative accounting and the creative financial maneuvering that’s intended to avoid taxes and is making use of tax mechanisms that were not really meant to be used in this way,” Cochrane explained.

While the federal government has been “consulting” on ways to modernize and strengthen the GAAR, Cochrane notes they have yet to take concrete action: “The government deserves to have their feet held to the fire over bringing in updated GAAR sooner rather than later because they’ve been promising to update it for a very long time and they’ve really been dragging their feet”

Cochrane adds that Canada also needs to “end all of its tax treaties” with tax haven countries – “what ends up happening is the combination of creative accounting and these tax treaties greatly increases the likelihood that those trying to avoid taxes can do so without running afoul of the law.”

After the United States and United Kingdom, tax haven jurisdictions like Barbados, Bahamas and Luxembourg have consistently ranked among the top destinations for foreign direct investment from Canadian corporations.

In 2021, the Canadian grocery chain Loblaws won a legal battle with CRA in the Supreme Court over $400 million that flowed through a subsidiary in Barbados, despite Loblaws operating no grocery stores on the Caribbean island.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate