Canada’s CEOs pad the numbers in tax report

The Canadian Council of Chief Executives released a report Monday trying to make the case that Corporate Canada pays more than its fair share in taxes. The problem is when you read beyond the headline, you realize the report from the lobby group representing Canada’s biggest corporations has more holes in it than the corporate […]

The Canadian Council of Chief Executives released a report Monday trying to make the case that Corporate Canada pays more than its fair share in taxes.

The problem is when you read beyond the headline, you realize the report from the lobby group representing Canada’s biggest corporations has more holes in it than the corporate tax code. And it exposes a transparent — and clumsy — attempt to distract attention from the decline in corporate tax paid as a share of profits.

The report makes the staggering claim that the 63 corporations who participated in the voluntary survey paid an average Total Tax Rate of 33.4% towards a Total Tax Contribution of $40.6 billion. Yet only $6 billion of this figure comes from federal corporate income tax (taxes on profits). A big chunk of the rest comes from tacking on every conceivable payment to government and calling it a “tax.”

Here are some ways the CEOs report pads the numbers:

- $14 billion refers to what they call “people taxes.” This includes Employment Insurance and Canada Pension Plan payments. But these aren’t actually paid by business, but are collected on behalf of the government. They’re paid by employees but deducted from payroll by employers. The report includes a clear disclaimer, but proceeds to ignore it. These should not have been included at all, and calling this a “tax” is inaccurate at best.

-

$5.7 billion refers to “other payments to government.” This figure includes “royalties paid to the government on conventional oil and natural gas production” and “application fees and rents/leases paid for the use of crown land and other,” or “environmental permits.” In other words, the CEOs are calling the payment of resource royalties and stumpage fees, as well as costs associated with enviornmental standards, is an add-on “tax.” This ignores that it’s entirely legitimate for the crown to charge companies for access to publicly owned resources. If resources were privately owned, a resource company would have to pay the private owners for use of the resources.

- $2.7 billion is attributed to “property taxes.” Setting aside the fact that office towers benefit in many ways from municipal services and infrastructure that don’t exactly pay for themselves, the report fails to point out that businesses can deduct property taxes.

Interestingly, many of the companies listed as participants in the report have an abysmal record at paying their fair share. A recent investigative report by Canadian Business magazine found that many corporations are aggressive tax planners and pay an effective (real) tax rate far below the statutory (how much they’re supposed to pay) corporate tax rate.

Canadian Pacific, for example, paid an effective tax rate of 1.8%, Canadian Natural Resources Ltd. paid 13.58% and Enbridge paid 14.24%. Each of these companies are listed in the Chief Executives’ report.

On the whole, corporations are paying less tax on their profits than ever. This chart, from a recent study by the Canadian Labour Congress, shows the rapid decline:

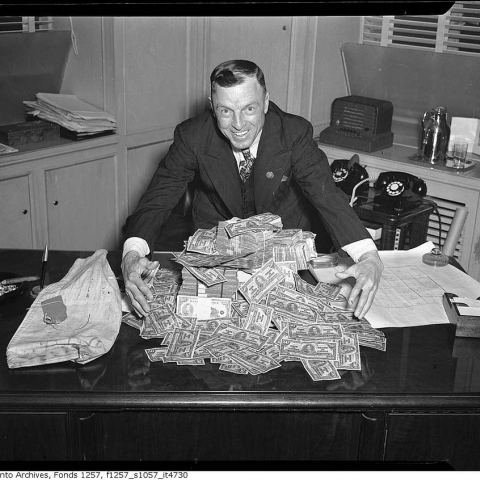

On the flip side, corporations have taken their corporate tax cut and hoarded the cash instead of investing in job creation. Corporate Canada is now sitting on a pile of “dead money” that is now larger ($626 billion) than the size of the national debt.

Photo: torontohistory. Used under a Creative Commons BY 2.0 licence.

Our journalism is powered by readers like you.

We’re an award-winning non-profit news organization that covers topics like social and economic inequality, big business and labour, and right-wing extremism.

Help us build so we can bring to light stories that don’t get the attention they deserve from Canada’s big corporate media outlets.

Donate